How to Choose Cloud Accounting Software for Pro-Practice

In this article, we’ll explain how you can go about choosing the right cloud accounting software for your accounting firm.

An invoice app is a tool designed to manage your invoices and payments. Some are better for entrepreneurs, some have more advanced features for larger businesses. Find yours here.

In this article we will help you understand what an invoice app is, when you need it and what type of app is the best fit for you and your business.

In this article

Did you know around 39% of your invoices are flawed?

This translated to friction with your clients, delayed or incorrect payments, and revenue loss.

Not ideal, especially if you’re dealing with 3-5 clients.

With an invoice app you can automate this process, save your recurring invoices or bills, and automaticaally send payment reminders.

An invoice app is a tool that helps you create, send, and manage your invoices easily.

These apps are particularly useful for small businesses, freelancers, and entrepreneurs who have several payers. For example, real-estate agents, translators, etc.

For larger business, an invoice app would definitely fall short because you would have to integrate with many other tools. In this case, we recommend using an accounting tool that can handle all of your finances in a more scalable way or invoice accounting software.

Invoice apps simplify the billing process by providing ready-to-use invoice templates that can be customized with your business logo, payment terms, and itemized details such as products, quantities, taxes, and discounts.

These tools also include automation features that will allow you to automatically send recurring invoices, track payments, calculate taxes, and send reminders to clients who have fallen behind in their payment schedule.

For small businesses, an invoice app is important to protect your bookkeeping and cash flow management.

Invoice apps and invoice generator both have the same goal: to create your invoices.

However, there are some differences.

An invoice app is designed to take over billing and invoicing management, including some automated features.

Invoice apps manage the full lifecycle of your invoices, including creation, delivery, and payment collection. You can store client data, track upaid invoices, send automated reminders, and integrate payments.

You can even take it further by choosing invoice apps that are integrated in accounting or bookkeeping software, where you can manage your whole finances.

On the other hand, an invoice generator is a much simpler and basic tool.

These are designed for microbusinesses or solopreneurs who have a unique payer.

With invoice generators you manually enter client details, products or services, amounts, and tax rates, then download or email the invoice as a PDF.

They provide speed and convenience, but once the invoice is sent, you typically lose visibility over its status.

If you only send one invoice a month, you can easily manage with tools like Google Docs, Excel, or a simple downloadable invoice template, or invoice generator.

However, once your business starts growing and you start to handle multiple clients, projects, or recurring payments an invoice app can save you from a lot of the struggle.

You’ll know it’s time to switch to an invoice app when:

An invoice app will help you save time, reduce human error and improve client relationships by making payments smoother and faster.

There are many invoicing apps you can choose from, including some free options.

However, before choosing your tool, there are some important features you should look out for.

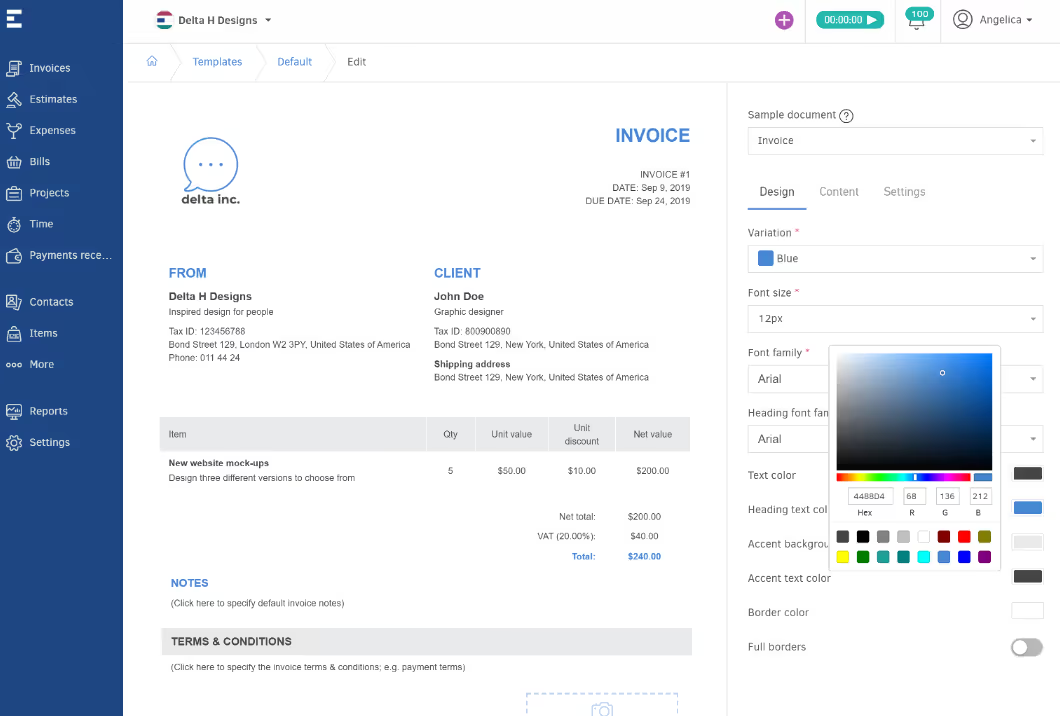

When you create your brand, you should make sure that all documents that come from you follow the same pattern, colour scheme and presentation because they will be associated to you and your brand.

Yes, presentation matters. Even in an invoice.

Many apps offer templates that you can customize to add your logo and brand colors. With templates, you will be able to keep your brand with a professional invoice without spending too much time on the design.

Some tools also give you the option to create reusable templates for different clients or services.

Once an invoice is sent, you need to know what happens next. The problem is that when you send out many invoices at the same time, loosing track of one can be easy.

The best invoice apps provide real-time tracking. This feature shows you when an invoice has been delivered, viewed, and paid.

This visibility helps you stay on top of pending payments without the need for manual follow-ups.

It also gives you data on average payment times, so you can identify slow-paying clients and adjust your processes accordingly.

Late payments are a common pain-point for small businesses.

When a client misses the payment deadline, they will automatically send a friendly reminder.

Aside from saving you the awkward email, it will help you focus on other tasks instead of having to check daily if there are any unpaid invoices.

If you have regular payments, such as retainers or subscriptions, you can automate these bills.

For businesses that charge customers regularly, such as service retainers, memberships, or subscription plans, recurring billing is a must-have feature.

Instead of manually generating invoices each month, the app automatically creates and sends them on a predefined schedule.

This automation saves significant time and ensures your recurring clients are billed accurately and on time.

Since invoicing involves sensitive financial and client data, security is non-negotiable.

Choose an app that provides encrypted data storage, two-factor authentication, and regular automatic backups.

A secure invoicing platform protects your business from unauthorized access, fraud, and data loss.

The best invoice apps allow clients to pay directly through the invoice using integrated payment options like credit cards, PayPal, Stripe, or bank transfers.

Bonus: Integration with bookkeeping and accounting tools

The most powerful invoice apps integrate seamlessly with your bookkeeping and accounting systems.

For example, Eleven combines invoicing with AI-driven bookkeeping, automatically recording each invoice, categorizing income, and reconciling transactions.

Efficient invoicing software is essential for maintaining healthy cash flow and ensuring accuracy in every client transaction. From freelancers to large enterprises, the right invoice app can automate billing, track payments, and simplify financial management. Below are seven of the best invoice apps to consider in 2026.

⭐⭐⭐⭐⭐ Rating

Capterra 4.9/5

Overview

Eleven is more than a simple invoice app, it is a complete accounting software that include all the necessary features any accounting firm needs. Including automated accounts payable and accounts receivable.

Eleven connects invoice management with AI-powered accounting, multi-entity control, and multicurrency reporting.

The system integrates seamlessly with ERP and accounting tools, ensuring invoices, payments, and reconciliations stay fully aligned across departments.

You can generate your invoices in seconds automatically or manually and save them for future entries.

Check out this video to see how to generate and create payments!

✔️ Pros

✖️ Cons

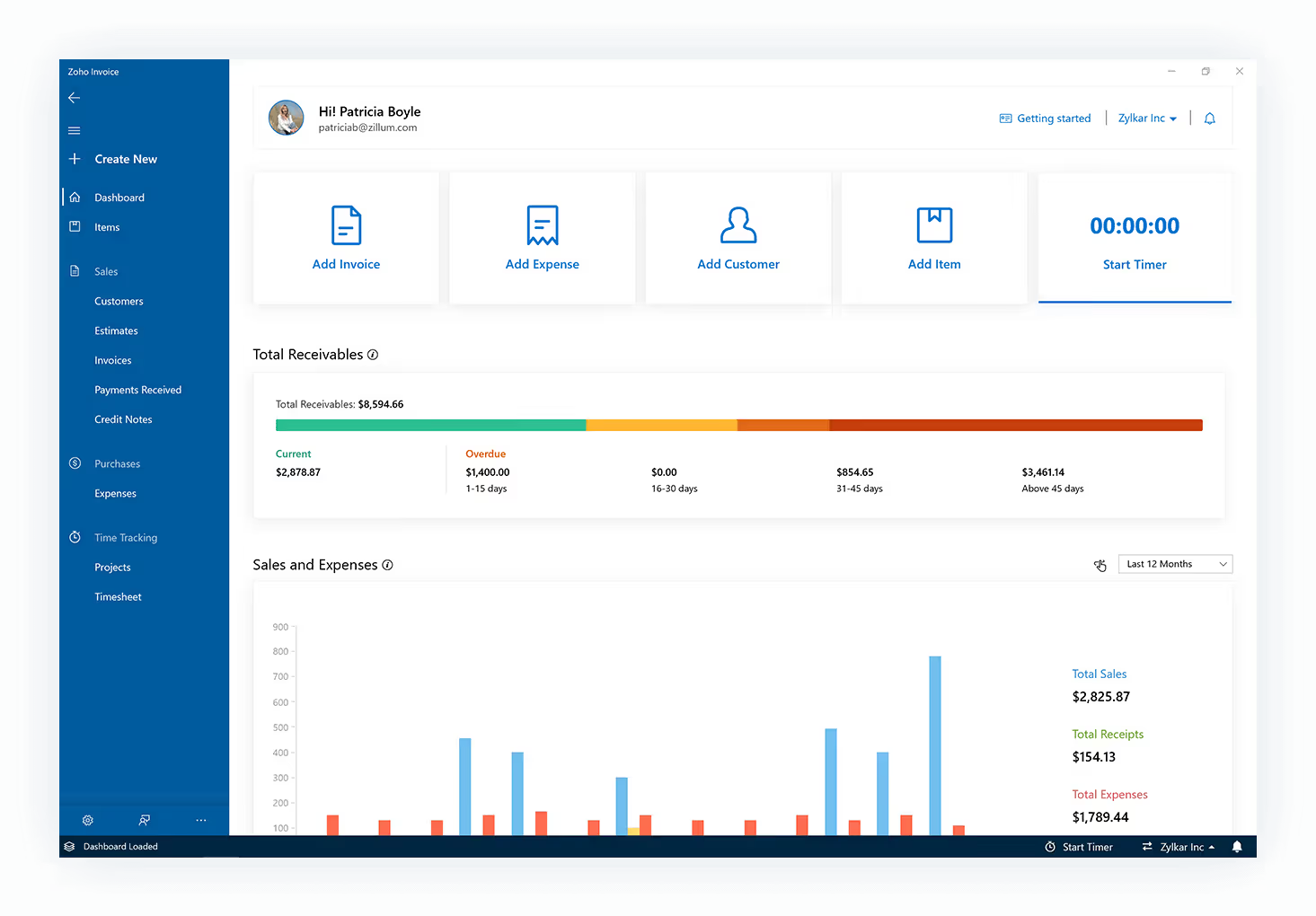

⭐⭐⭐⭐⭐ Rating

Capterra 4.7/5

Overview

Zoho Invoice is a free tool designed for freelancers and small businesses that can be downloaded for mobile or desktop.

With it, you can create professional invoices, track billable hours, and automate payment reminders.

The app is part of the Zoho ecosystem, which means it integrates easily with Zoho Books if you need more advanced accounting, reporting, or tax management capabilities.

✔️ Pros

✖️ Cons

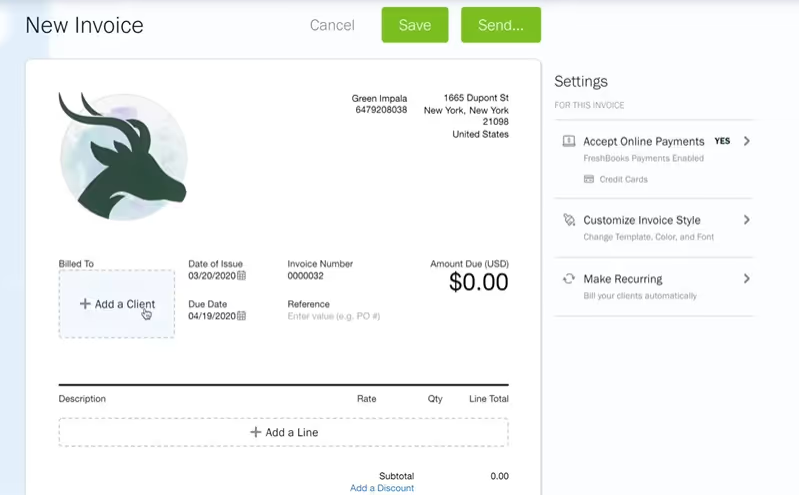

⭐⭐⭐⭐⭐ Rating

Capterra 4.5/5

Overview

FreshBooks is built for small businesses and service-based professionals who need easy time tracking, client management, and invoicing in one platform.

It simplifies recurring billing and expense tracking and provides real-time insights into payments.

FreshBooks also offers Integrations with payment gateways and third-party apps.

However, to send unlimited invoices, you will need to spring for the Premium plan.

With the cheapest plan, you can send 5 invoices per month, which is a good option if you only have a couple of payers.

✔️ Pros

✖️ Cons

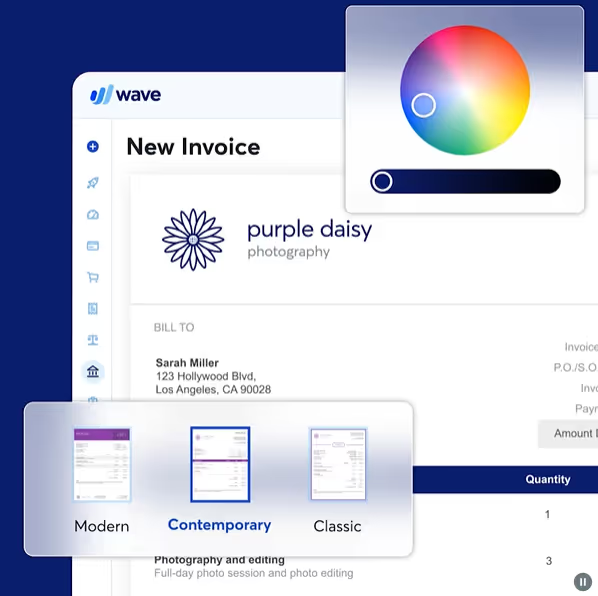

⭐⭐⭐⭐ Rating

Capterra 4.4/5

Overview

Wave is a web-based accounting tool that offers basic features for freelancers and small busineesses.

With Wave, you can create and send customized invoices. It supports online payments via credit card, bank transfer, and Apple Pay.

Wave connects with its built-in accounting tools, to sync payments and reduce manual bookkeeping.

You can manage customer information, track communications, and set up recurring billing or automated payment reminders.

You can send unlimited invoices with the free plan, although if you wish to automate the billing process, you will have to upgrade to the paid plan (at $190 per month).

✔️ Pros

✖️ Cons

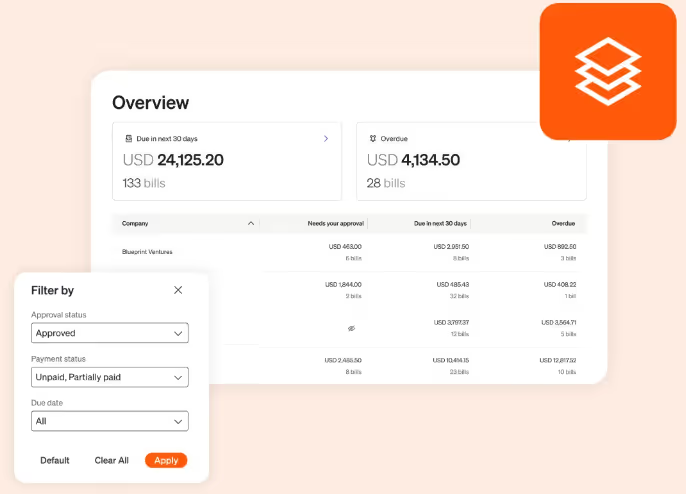

⭐⭐⭐⭐ Rating

Capterra 4.2/5

Overview

BILL.com is a financial operations platform that focuses on automated AP and AR.

BILL.com simplifies invoice approvals, digital payments, and cash flow management for complex businesses. If you need further accounting tools, you can integrate Bill.com with QuickBooks or Xero.

This tool allows automated recurring invoices, payment reminders, and an invoice tracker.

BILL.com also offers multiple payment options, including ACH, credit cards, virtual cards, and checks, allowing your customers to pay using their preferred method.

You can personalize invoice templates with your logo, layout, and custom fields to keep consistent branding.

✔️ Pros

✖️ Cons

⭐⭐⭐⭐⭐ Rating

Capterra 4.6/5

Overview

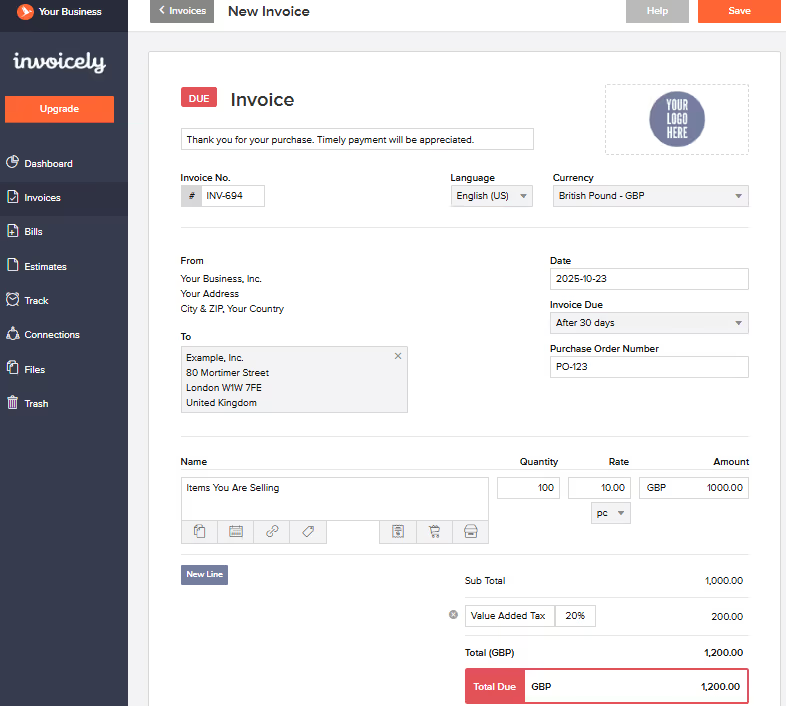

Invoicely offers a simple and affordable solution if you’re a freelancer or have a small company and you need to send invoices quickly.

It supports multiple payment methods, tracks time and mileage, and generates detailed reports.

Its free version is enough for basic needs, while paid tiers add branding, automation, and team collaboration features.

✔️ Pros

✖️ Cons

⭐⭐⭐⭐⭐ Rating

Capterra 4.9/5

Overview

Elorus is an invoicing, time-tracking, and expense management platform created for freelancers, small businesses, and agencies.

You can create invoices in multiple currencies, track billable hours, and manage client payments easily.

The platform also includes reporting features that provide real-time visibility into cash flow, outstanding invoices, and project profitability.

With its cloud-based design, Elorus supports team collaboration and integrates with payment gateways and accounting tools.

✔️ Pros

✖️ Cons

An invoice app is a tool designed to send invoices, track payments, and send reminders to late payers.

However, it isn’t always the best solution.

An invoice app is a great solution for small businesses, freelancer, and entrepreneurs who work with a limited number of clients or projects.

It will provide an easy way to handle billing, track payments, and keep professional-looking documents without the complexity of full accounting systems.

But if you manage multiple clients, subsidiaries, currencies, or complex financial processes, an invoice app alone will quickly reach its limits.

Accounting firms, family offices, and CPA practices require a more advanced, integrated system that goes beyond invoicing, such as Eleven.

If you’re a freelancer or small business sending a few invoices a month, a simple invoice app will do the job.

You can use ChatGPT to create invoice templates or generate invoice text, but ChatGPT itself is not an invoicing system.

While it can help you draft the layout, wording, and structure of an invoice, it doesn’t send invoices, track payments, or integrate with your accounting software.

The best invoice app depends on your business size, workflow, and budget.

Popular options include Eleven for AI-powered invoicing and bookkeeping automation, Wave for free invoicing features, Invoicely for entrepreneurs, and BILL for automated AR and AP.

Yes.

Reputable invoicing apps use encrypted data storage, secure cloud servers, and multi-factor authentication to protect sensitive financial and client information.

Always choose a platform that follows GDPR or other relevant compliance standards, and avoid sending invoices over unsecured channels.

Several invoicing apps offer free plans with essential features for small businesses or freelancers. Tools like Wave, Zoho Invoice, and Invoicely allow you to create, send, and track basic invoices at no cost.

Absolutely. Most modern invoicing apps are mobile-friendly and allow you to create, send, and manage invoices directly from your phone or tablet.