How to Compare Accounting Software for Your Accounting Firm

Learn the four key criteria that will help you cut through the jungle of accounting apps and choose the best one for your professional practice.

Late payments can leave profitable businesses short on cash. This guide explains accounts receivable management, why it matters, and how to manage it effectively.

Accounts receivable management ensures sales actually turn into cash. This article breaks down the process, risks of poor AR control, and how software simplifies it.

In this article

You can be profitable on paper and still struggle to pay the bills.

That situation is more common than many businesses expect, and it often comes down to accounts receivable. When customer payments arrive late or aren’t tracked properly, cash gets stuck.

Growth slows, decisions are delayed, and financial pressure builds, even when sales look strong.

Accounts receivable management exists to prevent this. It ensures revenue does not just appear in reports but actually turns into cash in the bank.

This guide explains what accounts receivable management is, how the process works, and how the right software can make it easier to manage.

Accounts receivable management is the process a business uses to track, control, and collect payments from customers who have bought goods or services on credit.

It covers the full lifecycle of a receivable, from setting payment terms and sending invoices to following up on overdue balances and reconciling payments once money is received.

Accounts receivable themselves represent money that customers legally owe to the business.

In accounting, these amounts are recorded as a current asset on the balance sheet because they are expected to be converted into cash within a short period, usually within the operating cycle.

It is important to separate the two ideas:

Accounts receivable and accounts payable are closely related but represent opposite sides of cash flow.

Accounts receivable is the money customers owe to the business and is recorded as a current asset. Accounts payable is the money the business owes to suppliers and is recorded as a current liability.

Managing both effectively is essential for working capital. Receivables represent incoming cash, while payables represent outgoing cash. An imbalance between the two can create liquidity issues, even when revenue is strong.

Accounts receivable management matters because it directly affects cash flow, working capital, and financial stability.

A business can record strong revenue and still struggle financially if customers take too long to pay.

When large amounts of money are tied up in unpaid invoices, companies may find it difficult to:

In some cases, they may need to rely on short-term financing simply to cover routine expenses.

Effective AR management improves visibility and predictability.

When invoices are sent on time, tracked consistently, and followed up in a structured way, businesses gain a clearer picture of when cash will arrive. This makes planning easier and reduces financial uncertainty.

It also reduces risk.

Invoices that remain unpaid for long periods are more likely to turn into bad debt. By monitoring receivables closely and acting early, businesses can lower the chance that amounts owed will never be collected.

Finally, good AR management supports better customer relationships.

Clear billing, consistent communication, and fair follow-ups reduce confusion and disputes, which helps maintain trust over time.

Accounts receivable management is not a single task. It is a continuous process that starts before a sale is made and ends only after payment is fully recorded.

The process begins with setting clear credit policies and payment terms.

Businesses decide:

Clear terms reduce misunderstandings and make later follow-ups easier.

Once goods or services are delivered, the business issues an invoice.

Accuracy and timing matter here. Incorrect amounts, missing details, or late invoices are common reasons customers delay payment.

After invoicing, outstanding receivables need to be tracked.

Most finance teams rely on aging reports, which show how long each invoice has been unpaid. These reports help identify which balances need attention and which customers may present higher risk.

If an invoice passes its due date, follow-up becomes necessary.

This can involve:

A consistent approach is far more effective than sporadic outreach.

When payment is received, the final step is reconciliation.

Payments must be matched to the correct invoices and recorded properly to keep financial records accurate and up to date.

Together, these steps ensure that sales turn into cash in a predictable and controlled way.

Most accounts receivable processes follow the same basic structure:

This framework helps reduce payment delays and supports healthier cash flow over time.

An accounts receivable manager oversees the entire receivables process. This role typically includes making sure invoices are issued correctly, tracking unpaid balances, organizing follow-ups, resolving disputes, and reporting on AR performance.

In many businesses, the AR manager also works closely with sales and customer service teams to address payment issues and ensure that credit terms are applied consistently. Their work plays a direct role in protecting cash flow and reducing financial risk.

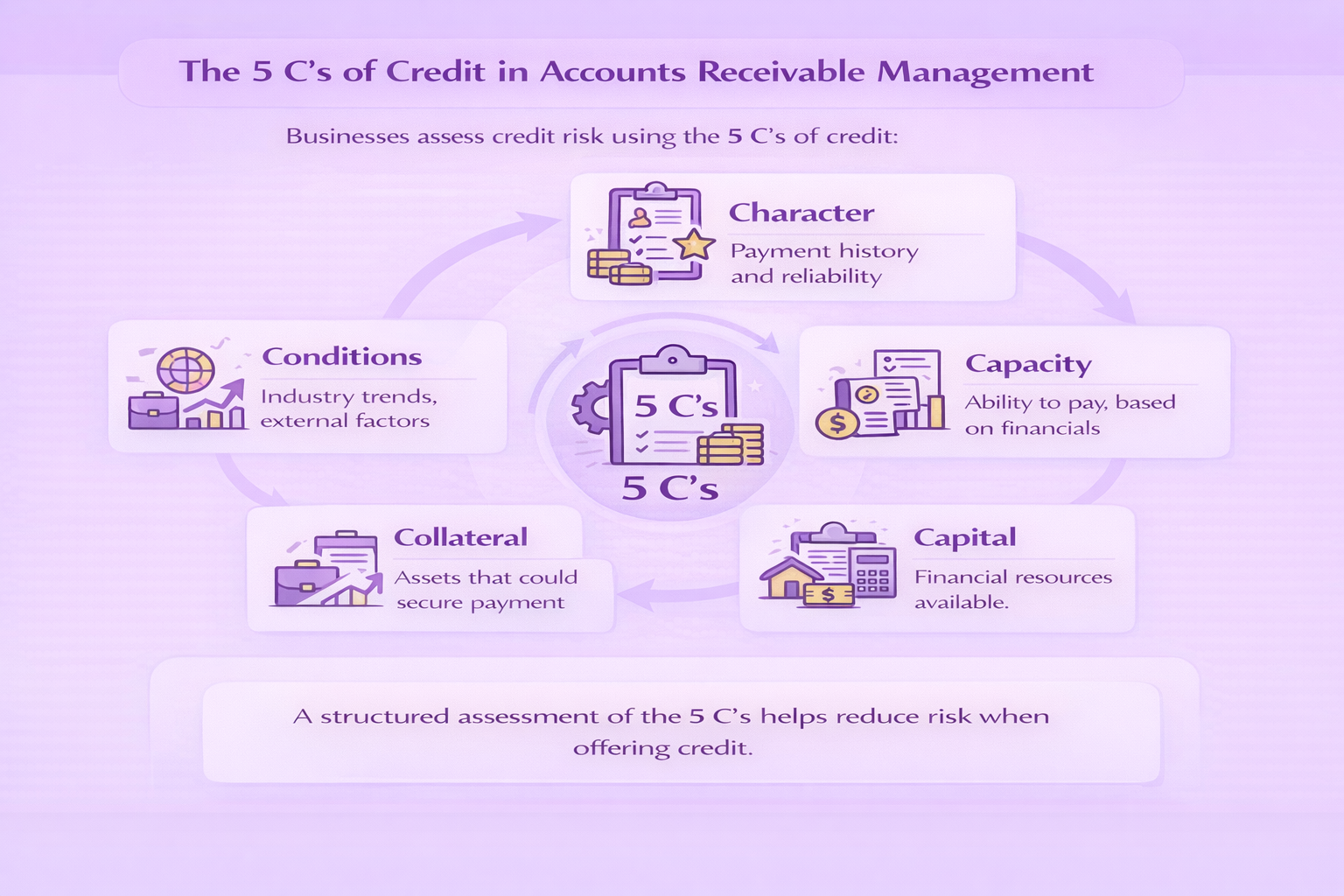

When businesses offer credit to customers, they often assess risk using the 5 C’s of credit:

Applying this framework helps businesses decide how much credit to offer and under what terms, reducing exposure to high-risk receivables.

Accounts receivable itself does not appear on the income statement.

Under accrual accounting, revenue is recorded on the income statement when a sale is made, not when cash is received. If the customer has not yet paid, the unpaid amount appears on the balance sheet as accounts receivable.

If a receivable later becomes uncollectible, the loss is recorded as a bad debt expense on the income statement. This is one reason why poor receivables management can eventually affect reported profitability.

When accounts receivable management is weak, the first impact is often felt in cash flow.

Money that should be available for daily operations remains tied up in unpaid invoices, making it harder to cover short-term obligations or respond to unexpected expenses.

Over time, the risk of bad debt increases.

Invoices that stay unpaid for long periods are less likely to be collected, which can lead to write-offs that directly reduce profits. Limited visibility into aging receivables also makes it harder to spot problems early.

Poor AR processes can also increase administrative workload.

Manual tracking, repeated follow-ups, and frequent dispute resolution take time away from more strategic work. Inconsistent or unclear communication may frustrate customers as well, which can weaken long-term relationships.

Software makes accounts receivable management easier to handle and more reliable. It helps teams send invoices, track unpaid balances, and reconcile payments accurately, without relying on manual processes.

Below are three commonly used accounts receivable and accounting tools, each suited to different needs.

An online accounting platform for family offices and CPA firms. It supports accounts receivable management within a broader accounting workflow, enabling teams to issue invoices, track receivables, and reconcile payments in one system.

Eleven also offers integrated document management via Dokmee, multicurrency support, and bank reconciliation, helping maintain accurate, auditable records across entities and clients.

A widely used accounting platform that includes invoicing and basic accounts receivable tracking. Users can issue invoices, monitor unpaid balances, and record customer payments alongside general accounting activities.

Tool that focuses on invoicing and payment management. It allows users to create invoices, track payment status, and accept online payments, with an emphasis on simplicity.

Accounts receivable management determines how reliably revenue turns into cash.

Without a clear process, businesses face cash flow pressure, higher bad debt, and extra administrative work. With the right structure in place, receivables become easier to manage and far more predictable.

Software supports this process by improving visibility and reducing manual work across the accounts receivable cycle.

If you want to see how this works in practice, book a demo with the Eleven team to learn how Eleven supports accounts receivable management as part of a unified accounting workflow.