What Is Cloud-Based Automation & Its Benefits for Your Firm

Boost your team efficiency, capacity, and productivity while reducing costs with cloud based automation. Find out how our cloud accounting software can help.

Learn the four key criteria that will help you cut through the jungle of accounting apps and choose the best one for your professional practice.

%20(1).avif)

Do a quick search for accounting software on Capterra or any other software review website and you’ll find around 10,000 products. Yet when you start making your way through this jungle of solutions, you’ll see that the market is dominated by cloud software for SMEs, and only a handful of apps are designed for professional practice.

In this article

The choice of accounting software becomes even more limited when you’re handling 20 clients or more. As one size never fits all, we can bet that you’re using two to three apps at a time to meet your firm’s needs, not counting Excel. This is hardly ideal.

In this article, you’ll learn how to compare accounting software for professional practice and choose an app that does the job without killing your productivity.

In this article, we'll define accounting software as specialized software that helps accountants process financial transactions and prepare basic reports such as balance sheets and income and cash flow statements.

Accounting apps can be categorized in different ways. Here are some categories we created after analyzing the offerings on Capterra:

%20(1).avif)

Notice that spreadsheet software like Excel doesn’t fit our definition of accounting software, as even though it offers built-in accounting templates, it isn’t specialized for accounting. In other words, you can’t just open Excel and do your books—you always need to customize it and make manual adjustments first.

What’s more, accounting managed in Excel does not easily come with double entry and, as a result, will yield to potential discrepancies building up over the years. In contrast, specialized accounting software only requires a one-time setup and data migration.

Test-driving and evaluating a long list of software solutions can take forever, which is why it's crucial to build a shortlist of three to four apps that are likely to meet your needs. This saves you from wasting time evaluating software that was never a good fit for your tasks in the first place.

With that in mind, here are the top four criteria that will help you establish a shortlist fast. These criteria reflect the most common business requirements we noted in conversations with managing partners from Singapore and Hong Kong.

We made this selection with small and medium-sized accounting firms in mind. Managing multiple clients is not a pressing issue for bigger industry players that handle fewer companies per accountant and use more complex and customized ERP systems.

The more features a product has the better, right?

Well, actually not so right. There are several reasons why this popular idea is flawed:

💡To find your sweet spot in terms of functionality scope, first analyze your current client needs and identify which software features will yield the best return on investment. Next, make sure that your software includes all core accounting features and performs them well.

Here’s a list of must-have features and functionality for professional accounting practices:

%20(1).avif)

When cloud apps first appeared, users had to choose between the mobility of the cloud and the stability of a desktop environment. Desktop solutions usually won out, thanks to established user habits and data security concerns.

However, now that remote work and collaboration are the order of the day, cloud adoption has skyrocketed. For accounting firms, collaborative flows are particularly important—of course you want to make your practice transparent and flawless, whatever the situation.

Still, from what we’ve seen, Excel and dedicated desktop programs such as MYOB are still widely used in small and medium-sized accounting firms. The reasons are financial rather than functional: it's cheaper to process low or high transaction volume clients with desktop apps that offer per-user licensing and unlimited transaction entries.

💡If your goal is to grow your practice and fully meet your clients’ needs, choose scalable cloud accounting software. This won’t just make your practice transparent and collaborative—it will also help you provide an exceptional service 24/7.

👉 Read more: Cloud Accounting Software vs Desktop Solutions: What’s Best for Your Practice in 2023?

What comes cheap comes easy, but it isn’t necessarily sustainable. Around 70% of the books are still done in spreadsheets simply because it doesn't make sense to pay for subscriptions for low-volume accounts or clients for whom the books are managed at year-end. Yet spreadsheets also bring down your firm’s productivity: falling back on Excel every time your software comes up short runs counter to the idea of a streamlined, automated workflow.

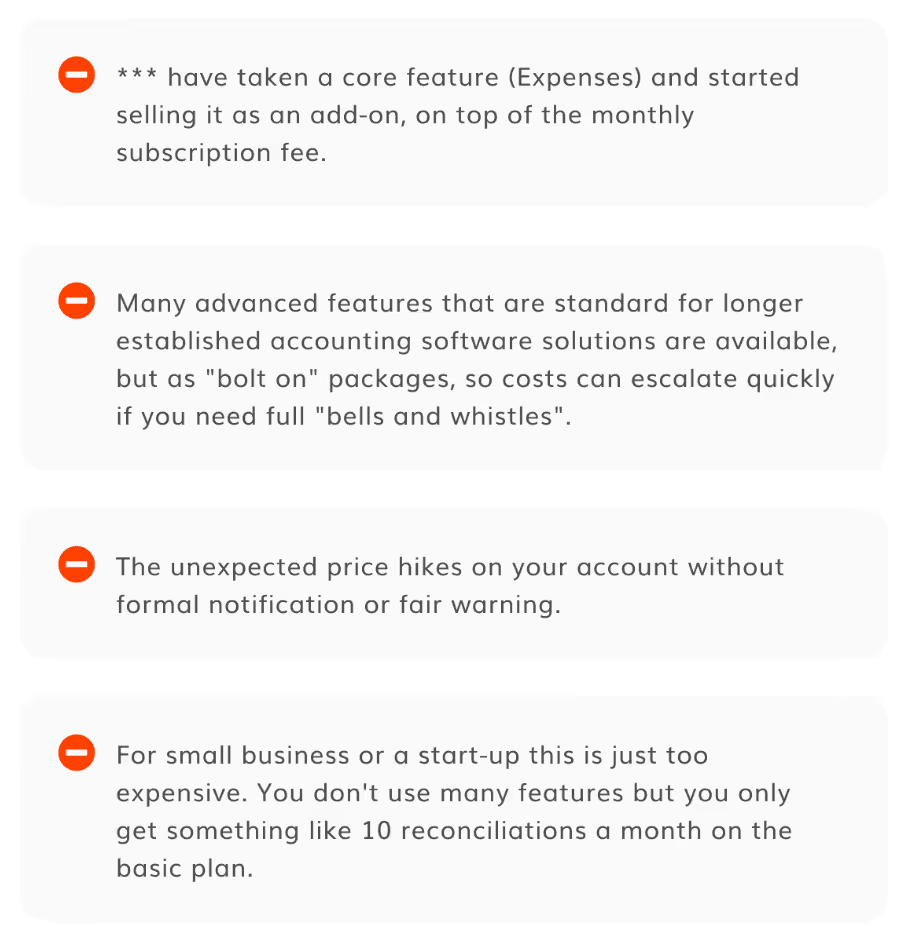

💡To stay productive while keeping subscription costs down, look for products with a flat or pay-per-accountant pricing model. This way, the price won't be linked to features or transaction limits and you won’t find that your favorite feature has suddenly been paywalled, as sometimes happens.

Accounting software needs to be fast whatever the number of transactions. The time it takes to go to the invoice page or even simply open an application affects an accountant’s productivity, so choose software that runs at a reasonable speed for your transaction volume.

💡Even if a software vendor claims its app runs without a hitch, make sure that there’s customer support service via phone, preferably in your time zone. The reason? If your clients have access to their accounts, prompt vendor support will spare you from answering questions about how to do this or that.

In summary, if you’re at a crossroads and wondering how to compare accounting software for your firm or practice, here’s what an ideal app should offer:

We can add that the ideal accounting software for a professional practice should combine the best of both worlds: it should be lightweight and collaborative like a modern cloud app, but also straightforward and accountant-focused like desktop software from the good old days.

And this is the idea behind Eleven: accounting software designed specifically for the tasks and budgets of small and medium-sized accounting practices. Built in close collaboration with accounting firms, it’s a blend of cloud app perks and desktop efficiency:

The accounting software market is saturated, which makes it hard to choose the best product for both your clients’ and accountants' requirements. If you’re wondering how to compare accounting software, start by analyzing your needs in terms of features and transactions, and make sure you leave space for business and client growth.

After this, quick-rate the apps you’re considering against our four criteria: functionality scope, cloud vs desktop, pricing model, and efficiency and support. You’ll soon see that the pricing model is a game-changer, as most cloud apps link their prices to feature and transaction limits.

Once you have your shortlist, book a demo with Eleven! We’ll be happy to help you with your evaluation process and answer any questions.