How to Choose Cloud Accounting Software for Pro-Practice

In this article, we’ll explain how you can go about choosing the right cloud accounting software for your accounting firm.

Late invoices rarely fail loudly. They fade into silence and slowly weaken cash flow control. This piece introduces dunning management as a structured way to prevent that drift.

Dunning management brings discipline to overdue invoice follow-ups without damaging trust. We explore how it fits into receivables workflows for CPA firms and family offices, and why strong accounting foundations matter.

In this article

Every finance team has seen it happen. An invoice goes out, the due date passes, and nothing happens.

No objection, no dispute, just silence. Individually, these missed payments may seem harmless.

Over time, they distort accounts receivable, reduce cash flow visibility, and force teams into reactive follow-ups.

This is where dunning management takes center stage.

This article explains what dunning management is, how it fits into accounting workflows, and how Eleven supports dunning-related processes through receivables oversight and reconciliation.

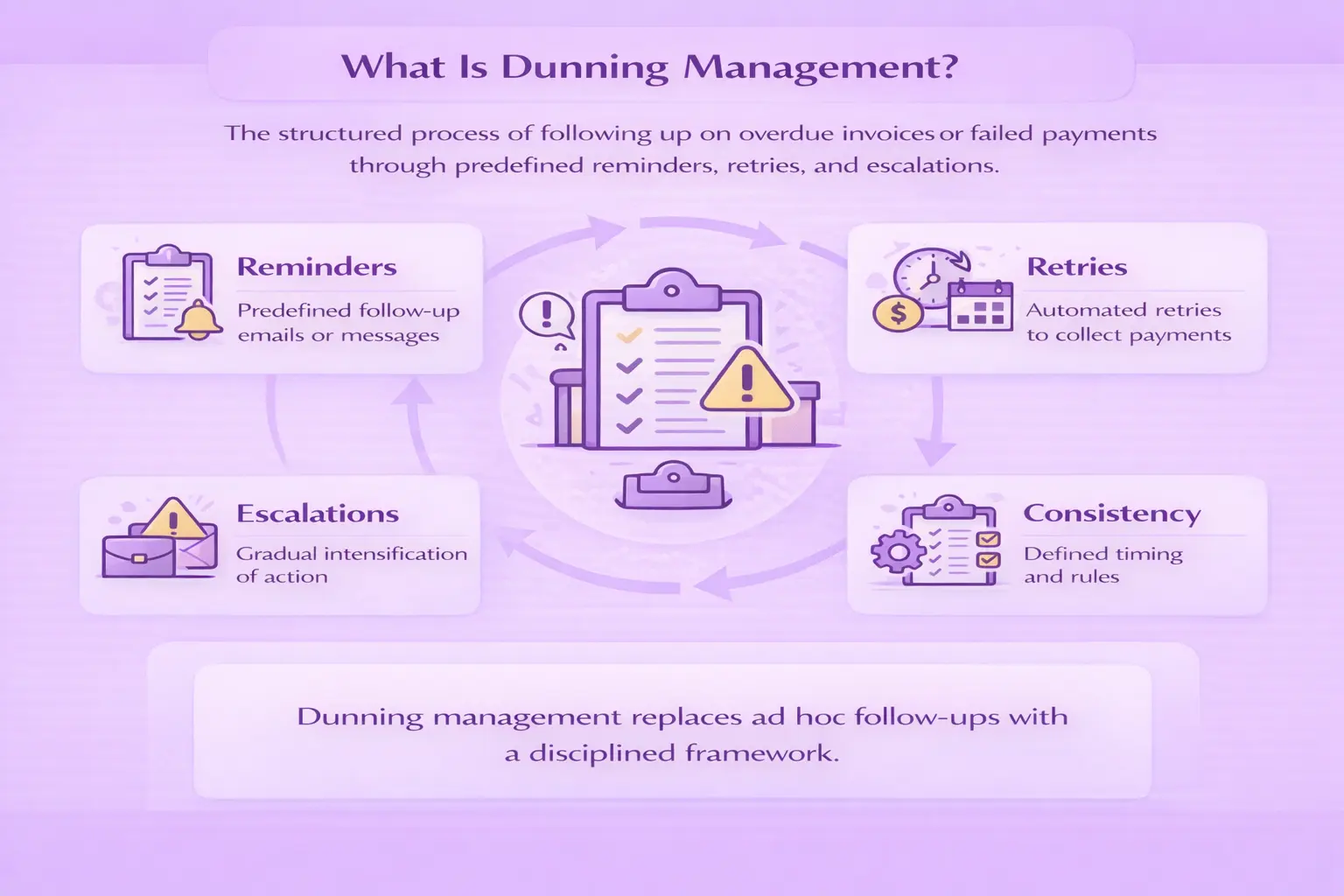

Dunning management is the structured process of following up on overdue invoices or failed payment attempts through predefined reminders, retries, and escalation steps designed to recover payment.

When people ask what is dunning management, authoritative accounting and billing sources describe it as a repeatable framework that replaces ad hoc follow-ups with consistent rules for timing, communication, and next actions.

Dunning is closely connected to accounts receivable management because unpaid invoices directly affect AR aging, expected cash inflows, and financial reporting accuracy.

Accounts receivable aging reports categorize unpaid invoices by how long they have been outstanding, such as 0–30 days, 31–60 days, and beyond. As invoices move into older aging buckets, the likelihood of successful collection decreases, increasing the risk of write-offs.

For CPA firms, weak dunning processes often lead to:

For family offices, the impact is different but just as serious:

Because of these risks, dunning is widely considered a core receivables control rather than a billing afterthought.

Before choosing a dunning approach, it helps to understand the scale of the issue. This calculator estimates how much cash may be tied up in overdue invoices based on your receivables (*not legal advice):

Most authoritative sources describe dunning management as consisting of several foundational elements.

Payments fail for reasons such as insufficient funds, expired cards, or bank processing issues. Identifying the cause of failure helps determine whether follow-up should be immediate or delayed.

Retry logic defines how often and when a payment should be retried after failure. Automated retry schedules are commonly used to improve recovery while reducing manual intervention.

Pre-dunning refers to reminders sent before a payment is due, such as upcoming invoice notifications or expiring payment method alerts. These steps aim to prevent failures rather than respond to them.

Email and client portals are the most common channels used in dunning. Best practices emphasize clarity, professionalism, and easy access to payment actions.

Industry guidance consistently warns against applying identical dunning rules to all clients or invoices. Different relationships, invoice sizes, and payment histories require different approaches.

In professional accounting contexts:

Segmenting dunning policies helps organizations balance recovery efficiency with relationship preservation.

Segment-based dunning involves grouping invoices or clients based on shared characteristics and applying tailored follow-up rules to each group.

Common segmentation criteria include:

For example, high-value or long-term clients may receive earlier personal outreach, while smaller balances follow automated reminder paths. This approach reduces friction while maintaining consistency across receivables.

Retry timing plays a significant role in payment recovery. Research and billing guidance show that retries scheduled at appropriate intervals perform better than frequent or poorly timed attempts.

Accounting and billing systems provide useful inputs for timing decisions, including:

Using these inputs allows finance teams to move from static schedules to data-informed retry strategies that improve recovery without increasing frustration.

In accounting contexts, dunning is best understood as part of receivables and credit oversight rather than debt collection. Accounts receivable management focuses on monitoring unpaid invoices and applying timely follow-ups to reduce bad debt risk.

So, when asking what is dunning in credit management, the answer is that it is a preventative process. It helps surface overdue balances early, apply consistent reminders, and reduce the likelihood that invoices become uncollectible.

This approach supports healthier AR aging and more predictable cash flow for both CPA firms and family offices.

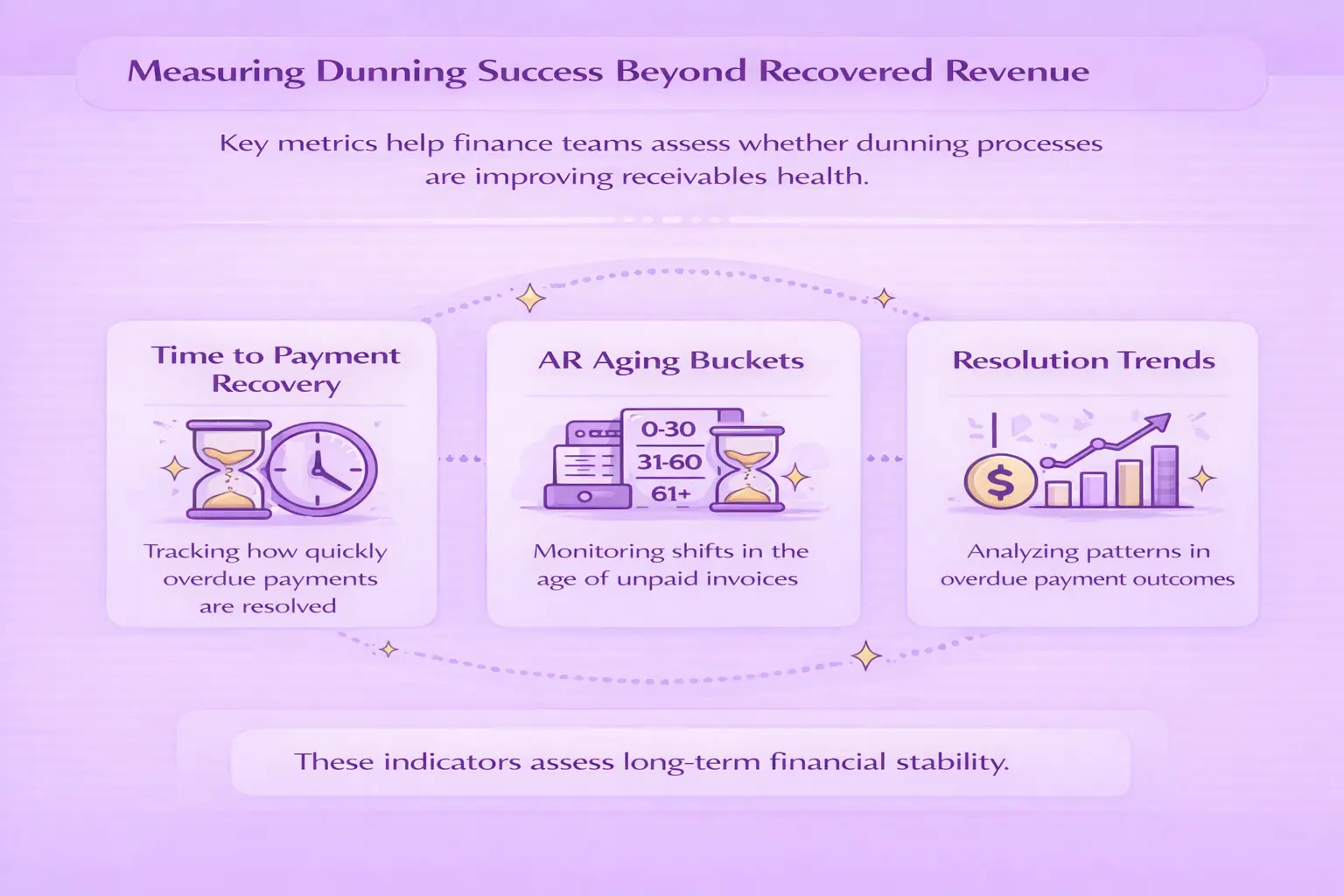

Recovered revenue is an important outcome, but best practices recommend evaluating additional indicators to assess whether dunning processes are actually improving receivables health.

Common measures include:

These metrics help teams understand whether dunning policies are strengthening long-term financial stability rather than solving isolated issues.

Effective dunning frameworks emphasize the importance of defined escalation paths. Not all overdue balances warrant the same response, and rigid cancellation rules can damage relationships unnecessarily.

Best practices recommend:

These distinctions are especially important for CPA firms and family offices managing long-term relationships.

A dunning management system is software that helps organizations track overdue invoices, manage reminder workflows, apply escalation rules, and monitor recovery outcomes in a structured way.

These systems generally fall into two categories: standalone dunning tools and dunning functionality embedded within broader platforms.

Standalone dunning tools focus specifically on payment recovery. They typically offer advanced retry logic, automated reminder sequences, and detailed analytics around failed payments and recovery rates. These systems are often used by subscription-based or transaction-heavy businesses where payment failures occur at scale.

However, standalone dunning tools rely heavily on accurate upstream financial data. Without clean invoice records, reconciled payment statuses, and up-to-date client information, even the most sophisticated dunning workflows can produce inconsistent results.

Many billing, payment, and accounting platforms include dunning-related functionality as part of a broader financial workflow. In these setups, dunning is closely tied to invoicing, receivables tracking, and reconciliation.

For CPA firms and family offices, this integrated approach often aligns better with how finance operations are structured. Rather than treating dunning as a separate system, it becomes an extension of receivables oversight, supported by accurate accounting data and consistent documentation.

In both cases, dunning systems are only as effective as the financial data they rely on. Industry guidance consistently emphasizes that strong accounting foundations are a prerequisite for successful dunning management.

Dedicated dunning systems focus on automating reminders and retries. However, those systems depend on accurate accounting data to be effective.

Eleven is an online accounting platform designed for CPA firms and family offices, providing centralized financial records, integrated document management, multicurrency support, and bank reconciliation.

These capabilities support dunning-related workflows by:

Accounting best practices recognize that effective dunning depends on clean receivables data and consistent financial records. Eleven provides this foundation, enabling finance teams to run dunning processes with clarity and control, even when using external tools for automated follow-ups.

Dunning management is a foundational receivables process supported by established accounting and billing practices:

For CPA firms and family offices, platforms like Eleven provide the receivables visibility and financial control that effective dunning management depends on.

If you want to see how Eleven helps you track receivables, keep records organized, and manage multiple entities, you can book a demo to see the platform in action.