Choosing Between Cloud & Desktop Accounting Software in 2023

Planning to revamp your accounting firm's tech stack? Let's compare cloud vs desktop solutions, so you can choose the best tool and upgrade your practice.

Small businesses have different needs and budgets than large enterprises. These 7 best bookkeeping software for small businesses promise to offer the necessary features without added costs.

The best bookkeeping software for small businesses have several things in common: simplicity, accuracy, clean interfaces, affordable pricing. In this article, we outline definitions, differences, features, and the 7 best tools for your small business.

In this article

Did you know nearly 51% of small businesses don’t use any accounting or bookkeeping software, relying instead on spreadsheets or manual methods?

If you’re still doing your books the old-fashioned way, you're falling behind, especially as tax laws, multi-currency, and remote work demand better tools.

Here’s your fast track to catching up: the 7 best bookkeeping software for small businesses, to handle what your business needs and support you in your growth.

Bookkeeping software is a tool that helps you record, organize, and manage daily financial transactions, such as sales, expenses, invoices, payments, and receipts. It automates many of the manual tasks (data entry, reconciliation, report generation), reduces errors, and gives you real-time visibility into your finances.

Who is it for?

So basically, if you’re doing more than just a few transactions per month, a bookkeeping software can save you time, increase accuracy, and free you to focus on growing your business.

Many people use “bookkeeping” and “accounting” interchangeably, but there is a subtle distinction in intent, features, and scale.

Bookkeeping software tends to focus on recording and classifying financial transactions, you enter or import sales, expenses, receipts, payments, then the software helps reconcile and produce basic reports.

Its job is to keep your everyday financial records tidy and up to date.

Accounting software, on the other hand, often includes bookkeeping features but goes deeper: allowing journal adjustments, budgeting, cost tracking, consolidation across multiple entities, more advanced tax engines, audit controls, and forecasting.

In other words, accounting software helps you analyze, correct, project and govern finances, not merely record them, much like an actual qualified accountant, as opposed to a bookkeeper.

A small business may start out using bookkeeping software and never need the full weight of accounting features - but the moment you have to handle multiple companies, cross-border transfers, advanced compliance rules or strategic forecasting, you’ll want that upgrade. That’s why the best bookkeeping tools are ones that are scalable and possibly even multi-currency - for when you go global!

In your small business, you need a specialized bookkeeping tool because the financial needs of small operations are unique. You’re often managing limited resources, juggling multiple roles, and don’t have the time - or budget - for a full-time accountant.

Bookkeeping software solves that problem for you by taking care of the financial groundwork, so you can focus on running your business.

Unlike larger enterprises that use complex accounting systems, small businesses benefit most from tools that simplify rather than overwhelm.

A good bookkeeping platform connects directly to your bank accounts, imports transactions automatically, and helps you track income, expenses, and invoices in one place. It turns what can be a disjointed manual process into an organized, consistent workflow.

The right software doesn’t just keep records, it gives you insight.

It can generate instant reports to show how much you’re earning, where your money is going, and whether your cash flow is healthy. It helps you stay compliant with tax rules and prepare financial documents without the last-minute stress.

Therefore, bookkeeping tools tailored to small businesses make it easier to be organized, efficient, and able to make wise and informed financial decisions - without needing to be an expert in accounting.

When choosing software for a small business, certain features make or break the experience. You don’t need every fancy module, but these are good to look for:

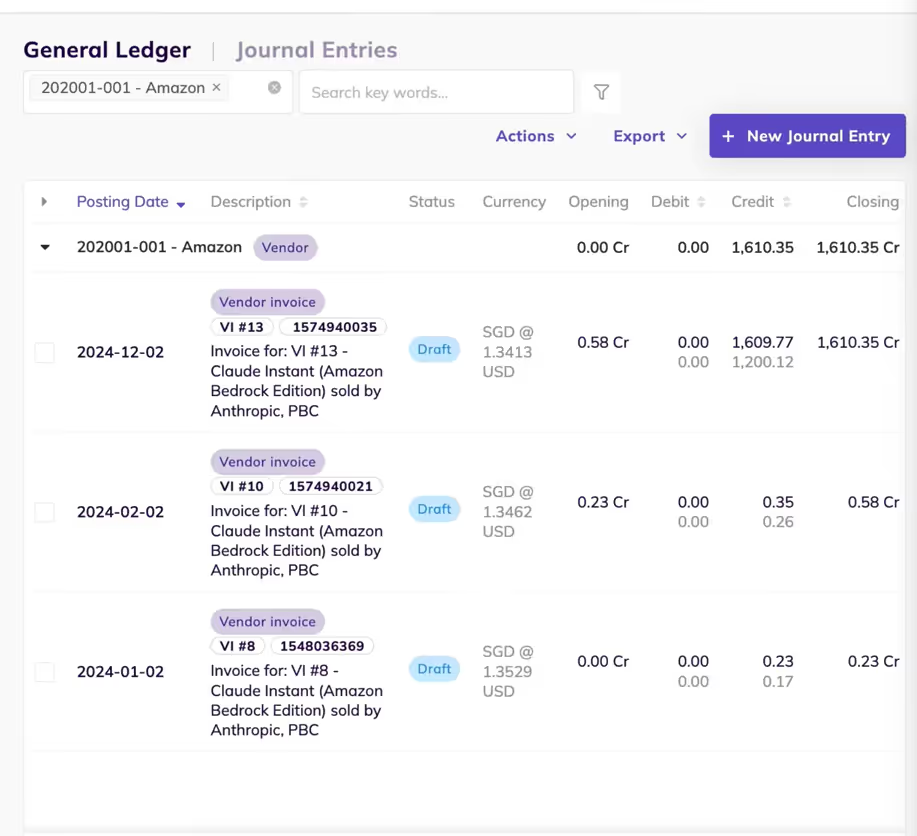

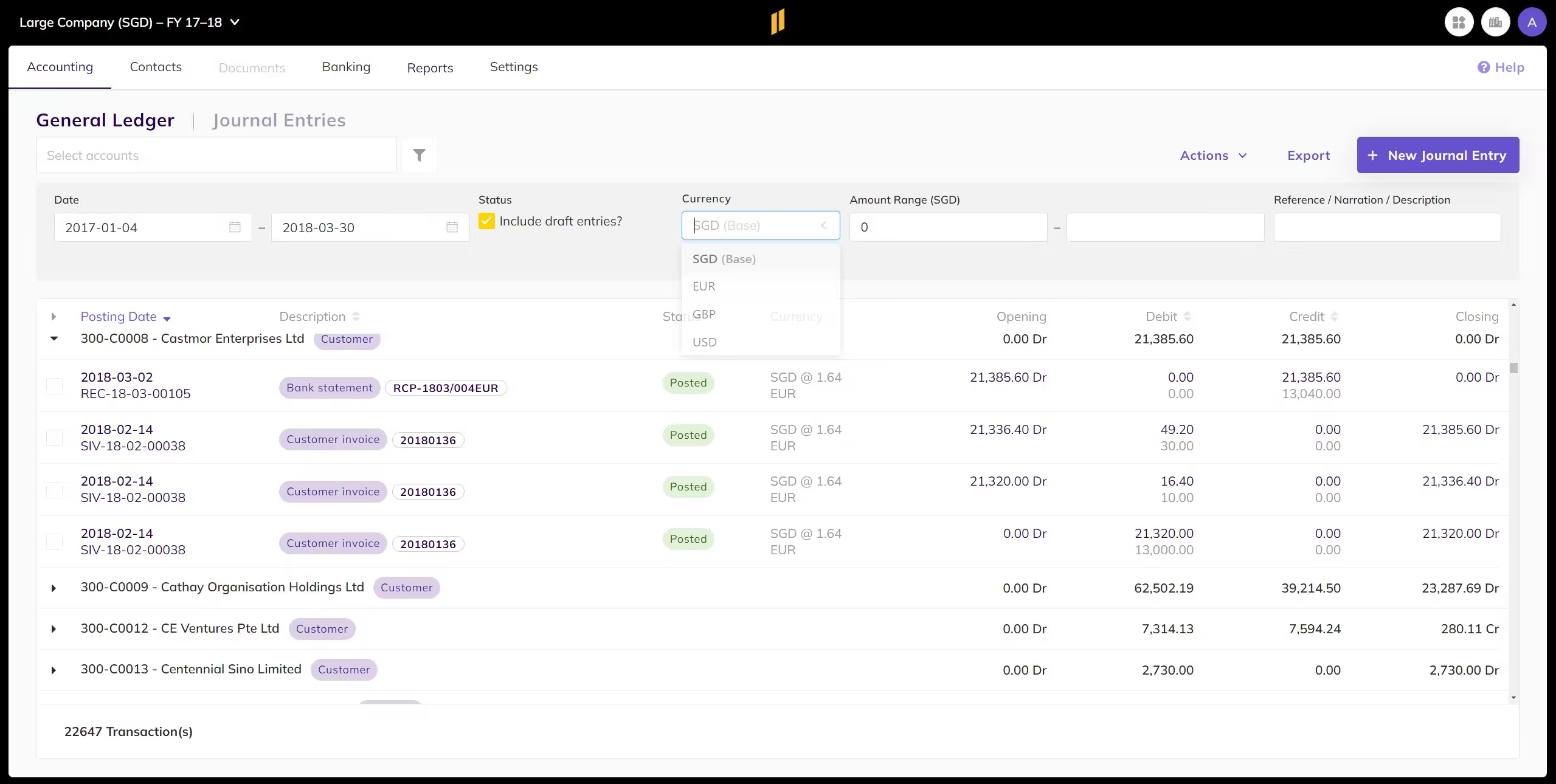

General ledger software is an accounting tool that records, organizes, and manages all of a company’s financial transactions in a unique dashboard.

It tracks every debit and credit across accounts such as assets, liabilities, equity, revenues, and expenses.

It will help you guarantee accurate double-entry bookkeeping, balanced books and reports.

With a scalable general ledger you don’t have to worry about your business outgrowing the software, as it is designed to handle increasing volume and complexity. With features like multi-currency and multiple entity management, as well as real-time reporting, you don’t have to compromise on performance to achieve growth.

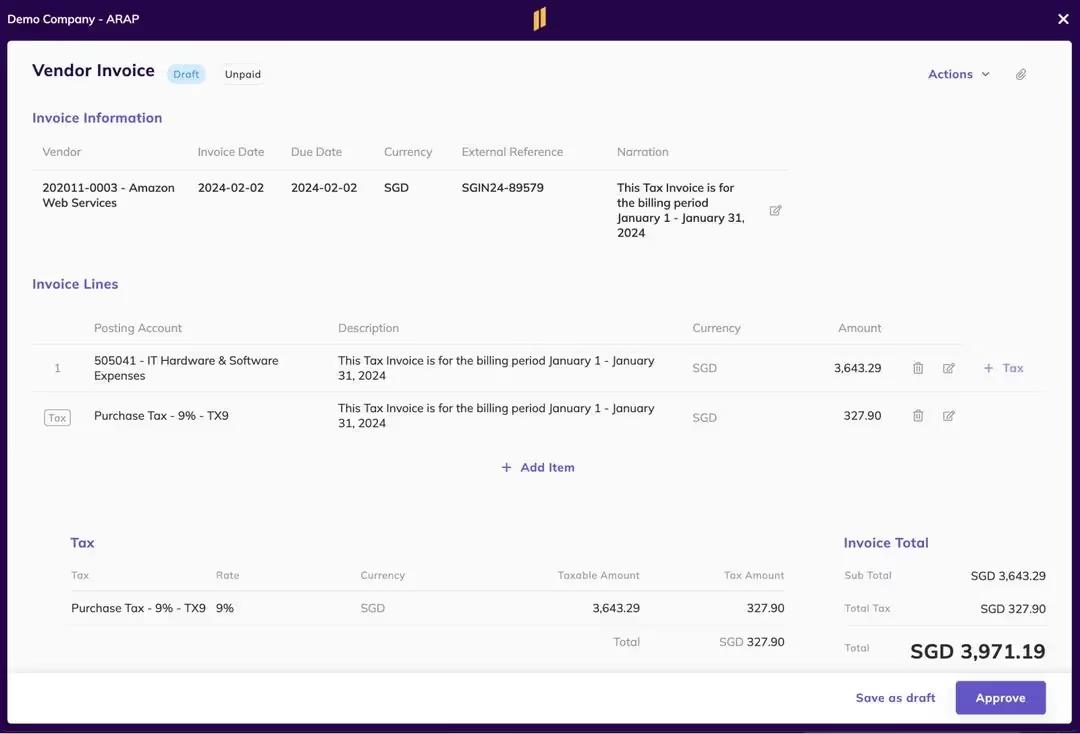

One of the major roadblocks in bookkeeping is the fluctuation in tax laws.

It is important that your bookkeeping app includes automated tax engine (VAT/GST and sales tax), allowing you to easily track, review and report taxes of any complexity.

Ideally, so your business can grow internationally, your software should support taxes in most jurisdictions - so you don’t get in trouble with anyone!

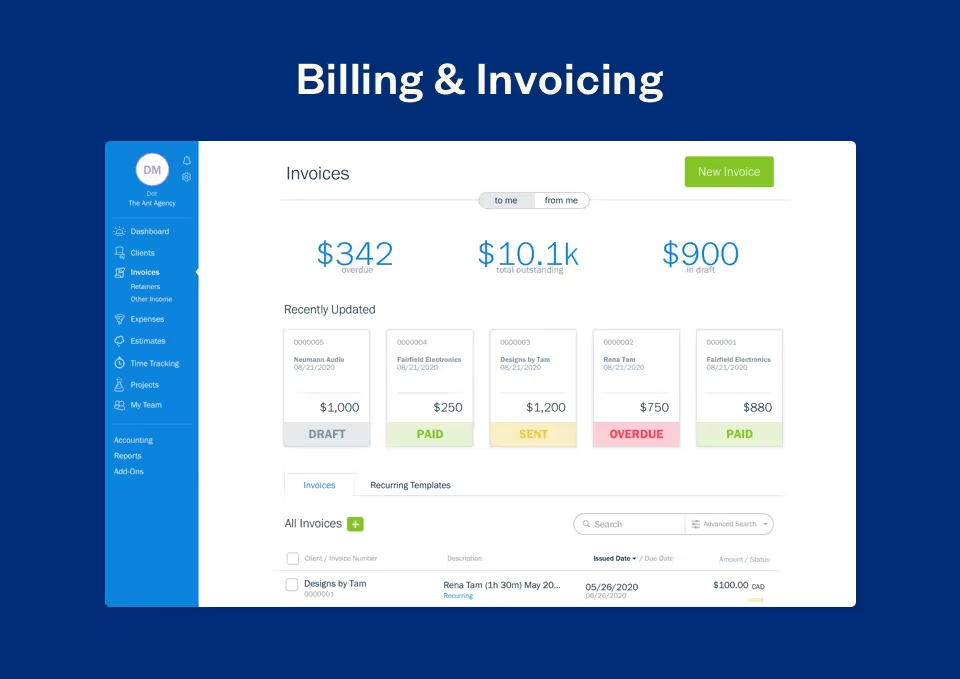

Automated invoicing and bill tracking will help you manage what you owe and what’s owed to you - using a bookkeeping software enables you to dispense with manual entry and template dependence - the tedious stuff - so you can focus on what really matters.

An AR/AP software tool should make payments across multiple invoices effortless, ensuring flexibility and convenience in managing your transactions.

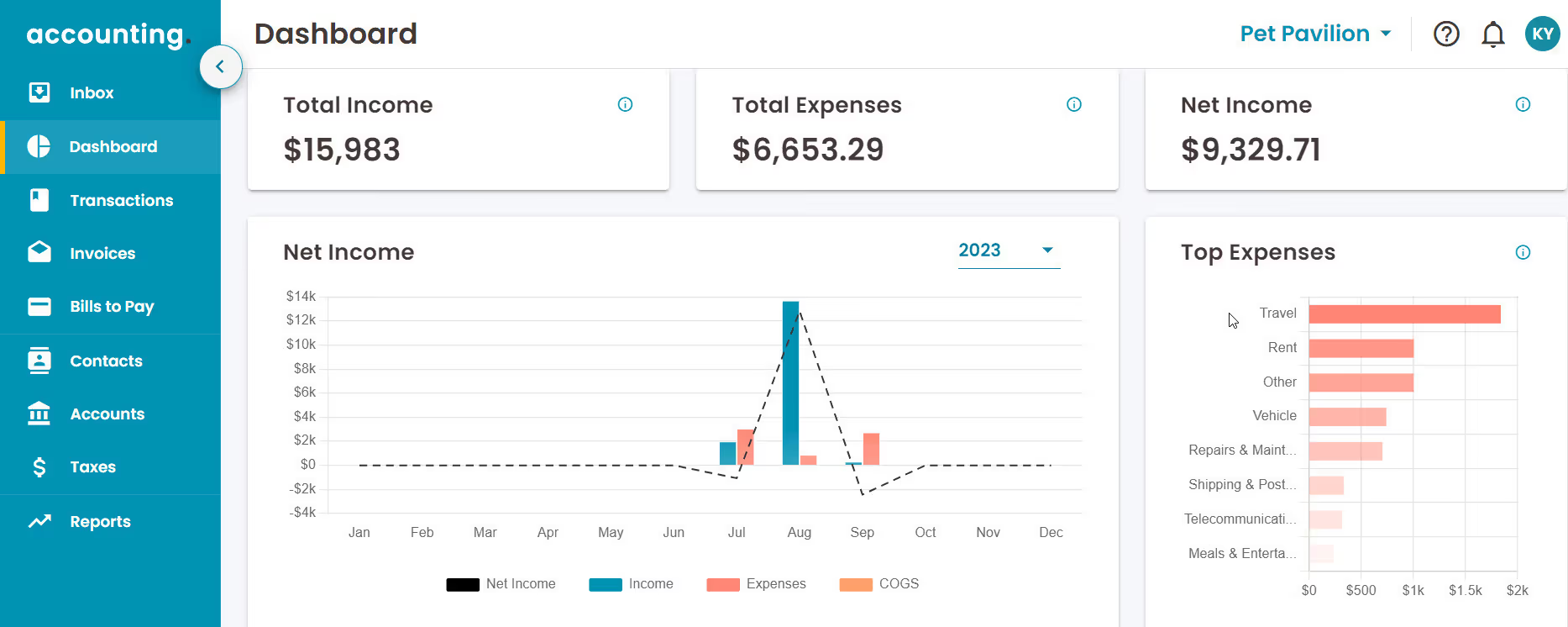

An analytical module should enhance financial management by offering detailed insights into costs, revenues, profits and losses.

Integrating seamlessly with modules like the general ledger, automated bookkeeping, and multi-currency accounting, is preferable to ensure precise resource allocation and performance evaluation.

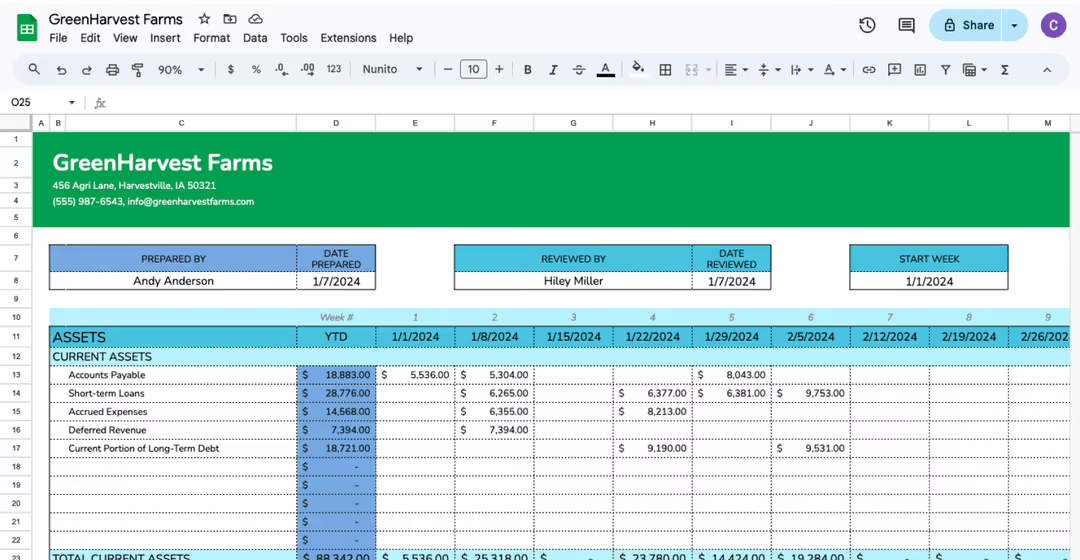

Dashboards should be able to visualize key metrics, track trends and support strategic decision making. Being able to export data into other business tools like Excel for further analysis is also important.

Auto-categorization, rule-based matches and recurring templates are a must if you want efficiency but you have a small team.

It is important that your bookkeeping software has automated data entry, month/year closing and reports for example, to save time and relieve stress by producing fast and accurate reports.

AI features can help to automate workflow and manage cashflow with data recognition and AI-powered invoice upload processes. You should also be able to set recurring payments and invoices - to reduce manual and repetitive tasks.

In bookkeeping, AI is designed to work with you, not against you. AI will not replace bookkeepers, but it will change your focus and strategy, so not implementing automation can mke you fall behind other competitors.

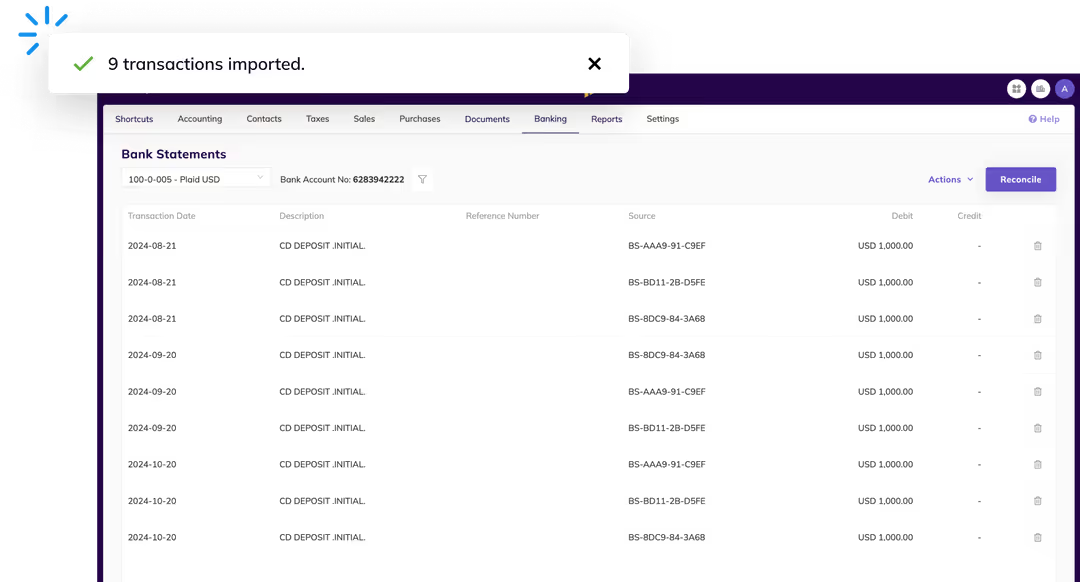

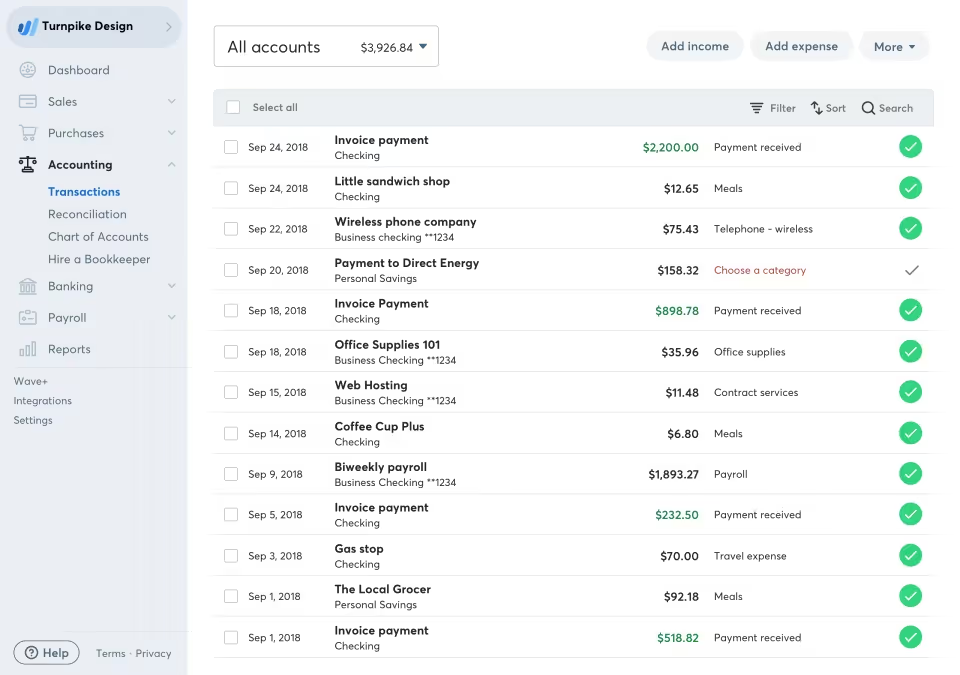

Your bookkeeping software should be able to connect to your bank feed and import financial transactions automatically so you don’t have to do it manually.

This will help you stay on top of your finances with the most accurate and updated view of your financial performance, thanks to real-time insights connected to your bank account.

This is essential if you're billing or paying internationally, allowing you to carry out transactions and reports in multiple currencies with up-to-date exchange rates, without complex entries or spreadsheets.

Your software should help you streamline this process, by allowing you to include several currencies and FX rates (either automatic or manually) within single journal entries, ensuring all balances and values are properly calculated and accurate.

Attaching receipts, invoices and image uploads should be made quick and easy with your bookkeeping software, making them streamlined for efficient record keeping , reviews and auditing.

You can also use this feature to organize all of your documents, helping you locate them when you need them and keep track of what’s missing so you can request them.

You can skip modules like deep consolidation, department cost allocation, advanced forecasting and even multi-currency until you truly need them.

Don’t forget to choose a tool that offers human and fast customer support to make sure you’re making the most out of your bookkeeping software at all times.

Below is a comparison table, followed by a closer look at each:

⭐⭐⭐⭐⭐ Ratings

Capterra 4.9/5

Overview

Eleven is scalable cloud accounting software for accounting firms. The app is tailored for professional practice both in terms of features and price, offering a sustainable competitive advantage for growing accounting businesses.

The platform covers all the core bookkeeping tasks (through automated bookkeeping processes) and is famous for its per-accountant pricing with unlimited entities; scalable and fast GL; extended multi-currency and tax support; multi-company interface; document management; custom reporting and dashboards.

Eleven helps growing accounting firms and small businesses that look for ways to increase capacity without losing margins. With Eleven, you can do accounting for every client, big or small, without falling back on Excel.

Features

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

Capterra 4.3/5

Overview

One of the most popular accounting tools, QBO offers strong functionality targeted to small and medium businesses.

It helps small businesses, especially in accounting, construction, and retail, manage accounting, billing, and financial reporting with daily-use tools and mobile access.

Reviewers highlight its ease of use and ability to connect with other business systems for smooth data flow. While pricing and performance are commonly cited drawbacks, recent updates like AI-powered dashboards and finance agents suggest a shift toward smarter automation.

Features

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

Capterra 4.4/5

Overview

Xero is a clean, modern and flexible accounting tool used in 180+ countries.

It helps small businesses simplify accounting, invoicing, and reporting.

Finance and admin teams value its clean interface and flexible reports. While support and budgeting tools have limits, standout features like profit or loss statements and payroll reporting can help you stay organized.

Recent updates, including Syft analytics and online payment integration, add depth for businesses who want to grow.

Features

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

Capterra 4.5/5

Overview

FreshBooks is a practical and intuitive software, popular among IT service businesses, freelancers, and small consulting firms who need fast, reliable invoicing and expense tracking.

It’s most used by marketing and IT services teams logging billable hours.

Users highlight its automation and financial clarity, though pricing and customization limits are common drawbacks. Recent updates such as financial lock and audit logs improve control and compliance.

Features

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

Capterra 4.4/5

Overview

Wave offers a free (or low-cost) bookkeeping tool aimed at very small businesses and freelancers. It’s most used by administrative teams and entrepreneurs who handle recurring billing - and prioritize simplicity over scalability.

It helps manage invoicing and basic accounting with a clean interface and mobile accessibility. Users value its free starter plan and invoice automation, though many cite slow ACH payments and limited support.

Advanced tools like auto-imported transactions and receipt capture are a plus for growing teams.

Features

✔️ Pros

✖️ Cons

⭐⭐⭐ Ratings

Capterra 3.6/5

Overview

TrulySmall is a time-saving accounting application that automates bookkeeping tasks and is designed for very small businesses or freelancers who want a bookkeeping tool with minimal complexity.

Kashoo designed this product for solopreneurs and microbusinesses.

Using machine learning, Kashoo categorizes and reconciles expenses with bank and credit card transactions, and provides accurate, complete, and real-time reports quickly. In addition to automatic reconciling, Kashoo also provides OCR and receipt-matching.

Simply drop an image of a receipt in the Inbox and Kashoo will automatically match it to a transaction.

Features

✔️ Pros

✖️ Cons

Ratings

Product Hunt 5/5

Overview

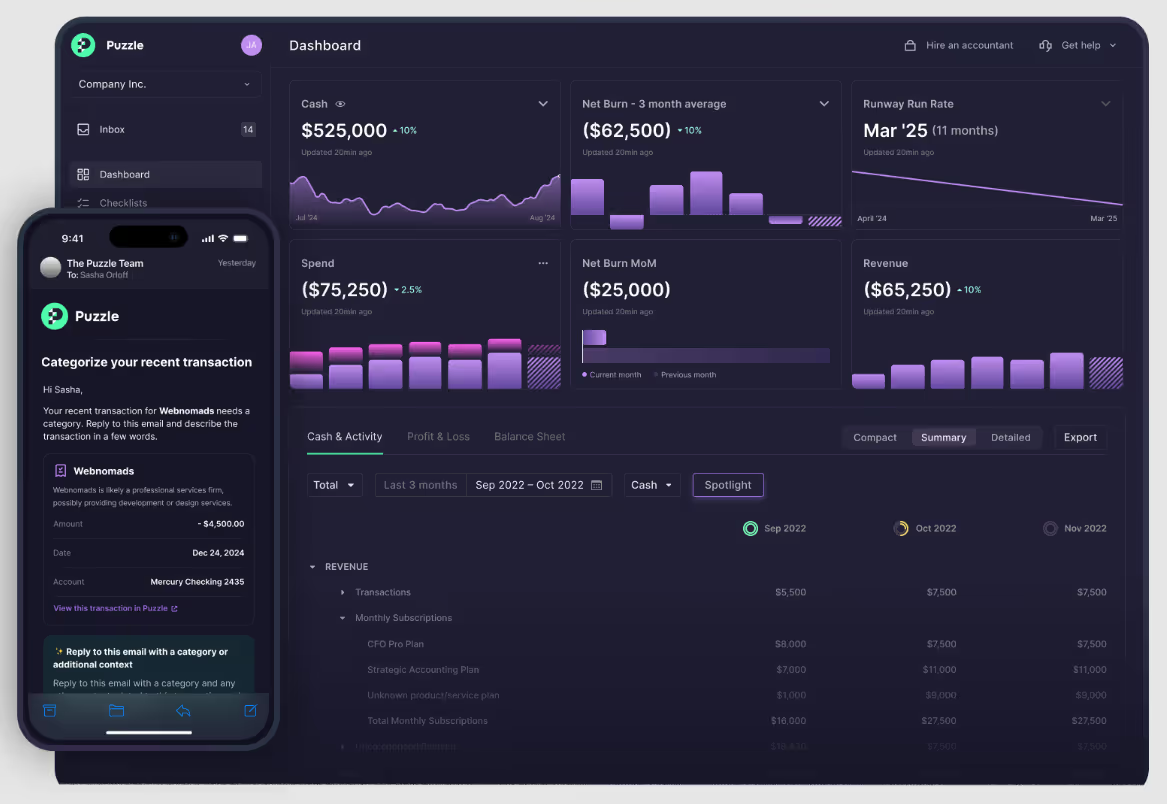

Puzzle is an AI-first bookkeeping tool aimed at startups.

It automates much of the categorization and reporting process, providing real-time visibility into financial performance.

It is a good option for tech-savvy small businesses and SaaS founders that want automation and insight without heavy manual bookkeeping.

Key features include real-time financial reporting, cash flow insights, ARR/MRR tracking, spend analysis, and financial statement generation.

Puzzle can be integrated with several tools, such as Stripe, Brex, and Gusto.

Features

✔️ Pros

✖️ Cons

Choosing the right bookkeeping software is about matching what you need now with what you might need later. In order to ensure that you make the right choice for you and your business’ needs, start by asking:

If you're only doing a few dozen entries a month, you may not need heavy automation yet. But if you expect rapid growth, ensure your tool can scale without forcing a full re-platform.

If yes, then multi-currency support (with live FX rates) is a must. Some tools only support it in higher tiers, so watch for that.

Planning the integrations you need is important, for example, will you import from Stripe, Shopify, bank accounts, payroll, point-of-sale systems, etc.?

Auto-categorization, rule matching, recurring entries - all these features save hours. If your tool does that well, you're already ahead.

Will you have multiple clients, entities, or expand into new jurisdictions? Can your tool handle that without too much friction? Can it scale with you?

Want to try a bookkeeping tool that’s scalable, good for multi-currency, and built with firms and small business growth in mind?

Consider giving Eleven a trial.

Test it with your real data (bank import, invoices, reports) and see if it fits your business - without overpaying for what you don’t yet need.