The Perks of Automated Bookkeeping for Accounting Pros

Still doing the books in Excel? Read on to learn why and how to automate bookkeeping to your advantage, even if you handle clients with few transactions.

Dedicated accounting software for CPA firms can guarantee to make your firm more efficient, accurate, offer more comprehensive reporting, without the risks of breaking tax laws or regulations.

Accounting software for CPA firms is an accounting tool with extra features designed to handle your clients’ tax preparation, bookkeeping, audits, reporting, and more…

In this article

If your CPA firm is still handling your clients’ finances the old fashioned way… you’re falling behind.

If you have implemented a generic accounting tool… you’re missing out.

If you’re looking for the best accounting software for CPA firms… we’ve got you covered.

Accounting software for CPA firms is a tool that is designed for Certified Public Accountants. These tools will typically handle tasks such as bookkeeping, tax preparation, compliance, audits, and financial reporting.

Accounting software has been created to increase both efficiency and accuracy, allowing you to expand your CPA firm and offer a more detailed and personalized service to all your customers.

Unlike general (or more basic) accounting and bookkeeping tools, an accounting software used in a CPA firm should focus more on more specific tasks, including handling multi-entity operations, tax law compliance, document management, and secure data storage.

More differences between a basic accounting solution and a dedicated CPA software include:

Taxes have evolved quite a bit in the past years, however, many firms still use the same processes.

However, more and more workers now work for international companies or in several companies at once, so their taxes become more complex and require more attention and research. The issue here is that it can take up time you could be investing in other clients.

So, essentially, when you’re handling multiple clients all with unique reporting requirements and different tax obligations, handling responsibilities manually can become somewhat of a nightmare.

Why?

You’re juggling paper files, spreadsheets, misplaced records, calculation errors, and delays.

However, investing in an accounting software means you can automate workflows and conversions, while keeping detailed audit trails that will help you trace every step of every process.

Where can accounting software help your firm?

Tax laws and accounting standards change regularly, making compliance a moving target for CPA firms and vary between countries.

Therefore, keeping track of every tax change in all countries and then applying these changes to your work in progress can b tricky and lead to pretty dangerous human errors.

Accounting software is continually updated to reflect new regulations, which reduces the risk of non-compliance.

For example, a firm handles 10 clients across several states. And there have been changes in 6 states over the past 3 weeks.

Trying to keep up with all the new jurisdication rules can be overwhelming and will inevitably cause the firm to make several mistakes.

The consequence of these mistakes can end up in large fines and losing the client.

With software that includes a universal tax engine, the firm can file sales tax returns or income tax reports correctly for each state without needing to build custom spreadsheets for every client.

Manual data entry can take up over 10 hours per week, if we don’t take into account major tax changes (that require extensive research) or bringing in new clients.

An accounting software allows you to automate routine and time-consuming tasks, such as manual data entry. Therefore, freeing up more than 1 full business day for more important tasks.

For example, instead of manually reconciling hundreds of bank transactions at month-end, the software can import bank feeds and match entries automatically.

A mid-sized CPA firm working with 200 small business clients might save hundreds of hours each month by automating reconciliations and report generation.

This time savings allows you to focus on higher-value services such as advisory work and financial planning rather than clerical tasks.

As mentioned, having to input data while going through stress, constant changes, and lack of time inevitably leads to mistakes, especially if you rely on spreadsheets.

Not to mention that a single mistake can completely change the entire outcome. A misplaced decimal or forgotten entry can throw off entire financial statements.

Accounting software reduces these risks by embedding formulas, compliance checks, and validation tools into the workflow.

For example, when preparing payroll tax filings for multiple clients, the software calculates withholdings automatically and cross-checks them against federal and state tax tables. This ensures accuracy and avoids penalties for misreporting.

Clients expect fast and accurate results from their CPA firms, however, that is typically not enough. Clients also want insights and advice.

Unfortunately, when you’re scrambling to get results quickly, you rarely have time for deeper analysis and detailed reporting.

An accounting software will improve client service by offering fast reports, tax filings, and insights. All these factors will allow you to give your clients an integral service.

For example, a business owner may request a financial projection ahead of an important loan application.

Instead of taking days to compile and verify data manually, you can generate a forecast report in minutes with the help of the software.

Faster delivery improves client satisfaction and positions your CPA firm as a trusted advisor.

Until recently, CPA firms have managed client files in paper format or through basic spreadsheets, and storing information in basic cloud-based document filing systems such as Google Drive.

This system requires constant manual data entry, unsafe storage systems, and cross-referencing documents.

Filing taxes often meant juggling various forms, calculators, and filing systems. This lead to slow processing, higher risk of errors, limited accessibility, and significant security risks.

Modern accounting software solves these issues by digitizing and automating processes.

Taxes can be calculated automatically, compliance updates are integrated, and reports are generated instantly. Secure digital document management eliminates the need for physical filing while encryption protects sensitive client information.

In short, CPA firms can handle more clients with greater efficiency and accuracy.

We’ve said it before, and we’ll say it again. Not all accounting tools are suitable for CPA firms.

You need to ensure that your tool has the following features to guarantee security, compliance and scalability:

CPA firms handle client’s financial data, which is extremely sensitive.

One single leak or security breach can lead to identity theft and financial lost for your clients, that could in turn, lead you and your firm to litigation and compliance issues that can completely ruin your reputation.

An accounting software will offer built-in advanced encryption to ensure that, even if data is intercepted, it remains unreadable to unauthorized parties.

Role-based access allows firms to restrict sensitive records only to relevant team members, reducing internal risks.

Secure backups, preferably in geographically distributed locations, guarantee business continuity even in the event of hardware failure, cyberattacks, or natural disasters.

So, if your CPA firm manages hundreds of personal tax returns during filing season, you can rest assured that all your data is encrypted and protected.

Tax filing season means endless calculations, high workloads, and stress.

Automated tax calculation tools within accounting software reduce this burden significantly. They handle payroll deductions, sales tax, and complex business tax computations with precision.

For example, if you’re preparing quarterly filings for a medium-sized business with 50 employees, the software automatically calculates payroll taxes, retirement contributions, and deductions, so you don’t have to resort to manual recalculations.

This ensures accuracy and frees up your time so you can advise your client and give them a better service.

This feature can cover you in two scenarios: You have international clients or your clients manage their finances in different currencies.

A multicurrency feature can automate foreign exchange adjustments and comply with international reporting standards.

For instance, if your U.S.-based CPA firm is working with a Canadian client, you’ll need software that can automatically reconcile USD and CAD transactions, apply real-time exchange rates, and produce accurate reports for both U.S. GAAP and IFRS requirements.

Multicurrency features prevent costly manual conversions and compliance oversights.

Tax laws and regulations fluctuate constantly, especially if you’re dealing with international clients, or in the U.S. if your clients are scattered across different states.

Keeping track of all tax regulations can be, to say the least, tricky.

A universal tax engine ensures that your can apply the right tax rules automatically, no matter where your clients operate.

If you have several clients that are operating under different tax regulations, you no longer have to keep complicated, separate spreadsheets. Instead, the software calculates and applies the correct state tax rates seamlessly, saving hours of manual review and reducing the risk of noncompliance.

It is incredibly easy to fill your file cabinets with tons of paper documents, the issue is when you need a specific document and you need it quick.

Additionally, saving your documents in your email’s inbox or on different files and systems can also become disorganized, leading to misplacement, duplication, and security lapses.

A built-in document management system (DMS) will centralize, store and enforce governance through advanced indexing or metadata tagging.

Your clients will be able to upload their documents directly to your firm’s encrypted portal and you will be able to access them much more efficiently.

This ensures compliance with privacy regulations and reduces turnaround times.

CPA firms who adopt a DMS often report significant savings on administrative overhead and improved client satisfaction due to the convenience of secure digital sharing.

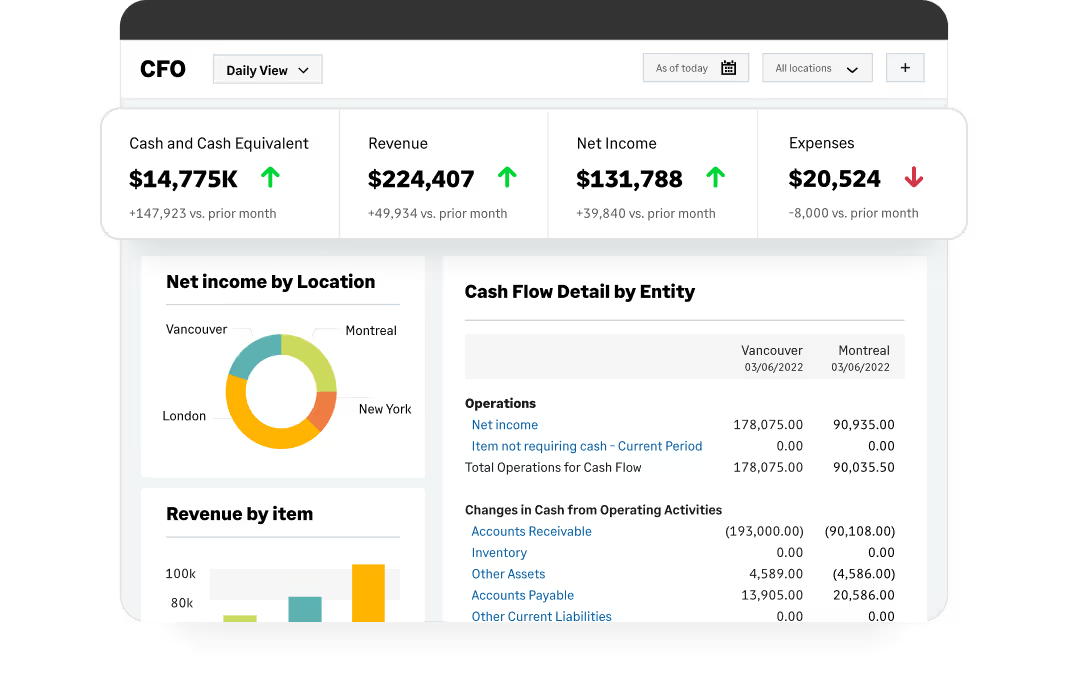

Detailed reports are a must in your CPA firm. However, preparing the most comprehensive reports takes time.

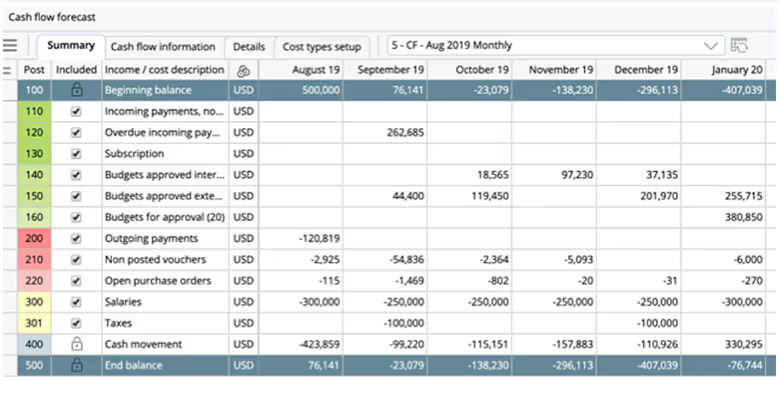

Advanced reporting capabilities go beyond simple profit-and-loss statements. They allow you to create audit-ready financial statements, custom management dashboards, compliance-focused summaries, and year-over-year comparative analyses at the click of a button.

For example, a client who is going to apply for a bank loan for a mortgage may need a cash flow forecast. Instead of spending days compiling spreadsheets, you can produce a detailed report in minutes, backed by real-time data.

Or you can give your clients the best investment advice.

Such speed and accuracy strengthen client trust and demonstrate your value as a strategic advisor.

There are many types of accounting tools. Some are meant for finance teams, some for accounting and bookkeeping firms, and some are better suited for CPA firms.

Let’s compare 7 of the most popular (and favorite) accounting tools.

⭐⭐⭐⭐⭐ Ratings

Capterra 4.9/5

Overview

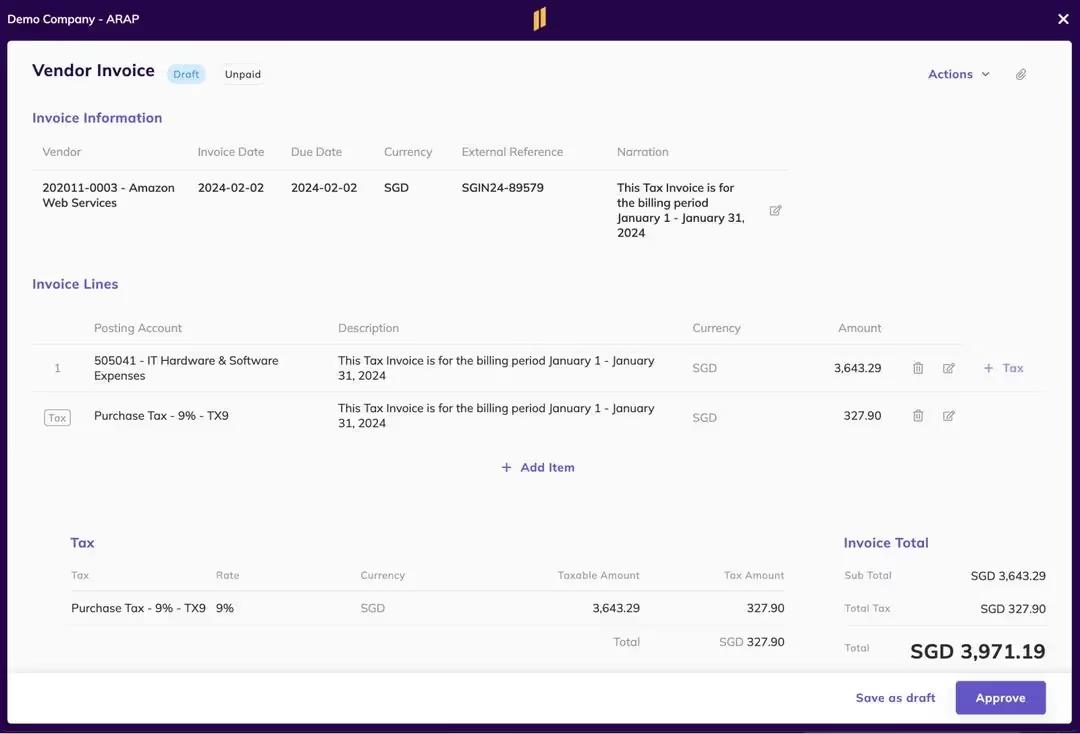

Eleven is an accounting software designed for CPA and family firms, as it blends financial management and solid security.

To protect your client’s data, Eleven uses encryption for sensitive tax documents, client records, and compliance files, therefore reducing dramatically the risk of data breaches.

In addition, Eleven supports day-to-day practice workflows such as tax filing, financial reporting, and client collaboration in a secure, centralized environment.

Unlike other accounting tools, Eleven has a built-in DMS that will store, manage, and organize all of your firm’s and clients’ data so you can access it at any time.

Best features for CPA firms

Who is it for

Eleven is best suited for CPA firms, tax professionals, and accounting practices that manage large volumes of confidential financial data.

It’s particularly valuable for firms transitioning from general online storage solutions to industry-grade systems with compliance and security at the forefront.

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

G2 4.2/5

Overview

Deltek is an enterprise-level accounting and project management software designed to support firms that balance financial accounting with client project oversight.

This software integrates time tracking, billing, resource allocation, and compliance monitor into one system.

Deltek is a useful tool for CPA firme who manage large client bases o multi-phase projects.

Firms often highlight its ability to handle complex client engagements, resource management, and compliance requirements, though some note that its interface and setup can feel more complex compared to lighter accounting solutions.

Best features for CPA firms

Who is it for

Deltek is best suited for CPA firms that handle project-based work or offer services beyond tax and audit.

Large accounting and CPA firms will find Deltek’s combination of project management and financial tracking particularly valuable.

✔️ Pros

✖️ Cons

⭐⭐⭐Ratings

G2 3.4/5

Overview

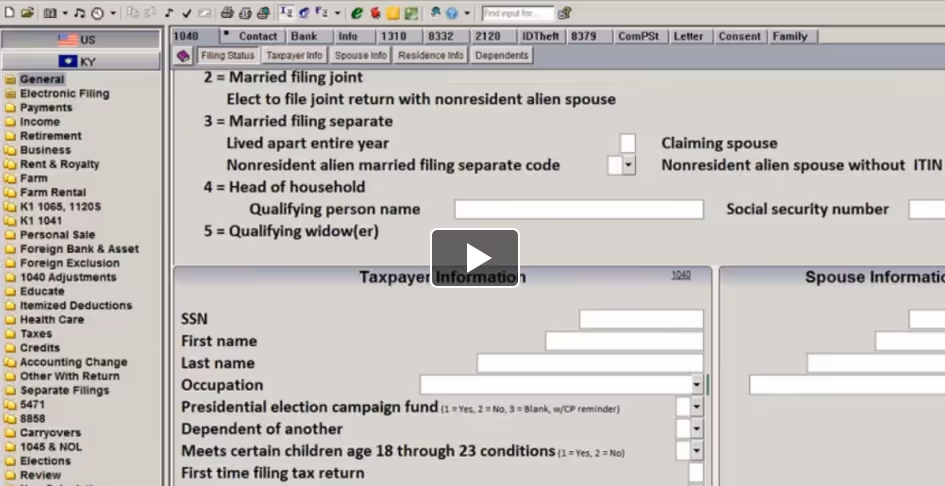

Thomson Reuter’s Virtual Office CS is a cloud-based software that includes tax, accounting, and practice management applications.

UltraTax CS integrates seamlessly into the virtual office.

UltraTax is is a tax compliance and preparation tool built for accounting firms.

This tool manages tax preparation with built-in diagnostics, e-filing capabilities, and automated compliance checks.

UltraTax CS is quite popular among CPA firms for its deep compliance capabilities and integration with the Thomson Reuters CS Professional Suite. Firms highlight its efficiency in handling complex tax returns, multi-state filings, and electronic submissions.

Many reviewers note that while it’s a powerful system, it comes with a steeper learning curve and higher cost compared to more lightweight tax solutions.

Best features for CPA firms

Who is it for

UltraTax CS is best suited for mid-sized to large CPA firms that manage complex client tax scenarios, including multi-entity and multi-state filings.

Firms already using other Thomson Reuters CS applications benefit most, as the ecosystem offers a tightly integrated practice management and compliance solution.

✔️ Pros

✖️ Cons

⭐⭐⭐⭐ Ratings

G2 4.3/5

Overview

Sage is an accounting and financial management software that has a separate product for accountants, Sage for Accountants.

This tier is best option for CPA firms, as it offers financial reporting, budgeting, and cash flow management.

Unlike smaller accounting tools, Sage scales to support mid-sized and large firms that manage multiple entities, complex reporting requirements, and high transaction volumes.

Sage is praised for its flexibility, scalability, and strong financial management features.

Many CPA firms note its reliability in handling general ledger, accounts payable/receivable, and financial reporting at scale.

However, if you choose Sage, you will need a separate tool for tax and auditing tools with good integrations so you can build a full CPA workflow.

Best features for CPA firms

Who is it for

Sage is best suited for mid-sized to large accounting firms that require advanced financial management.

However, it is better suited for CFOs and Finance teams in large enterprises.

Firms with diverse service offerings or complex client portfolios benefit from Sage’s scalability and customizable features.

✔️ Pros

✖️ Cons

⭐⭐⭐⭐Ratings

G2 4.5/5

Overview

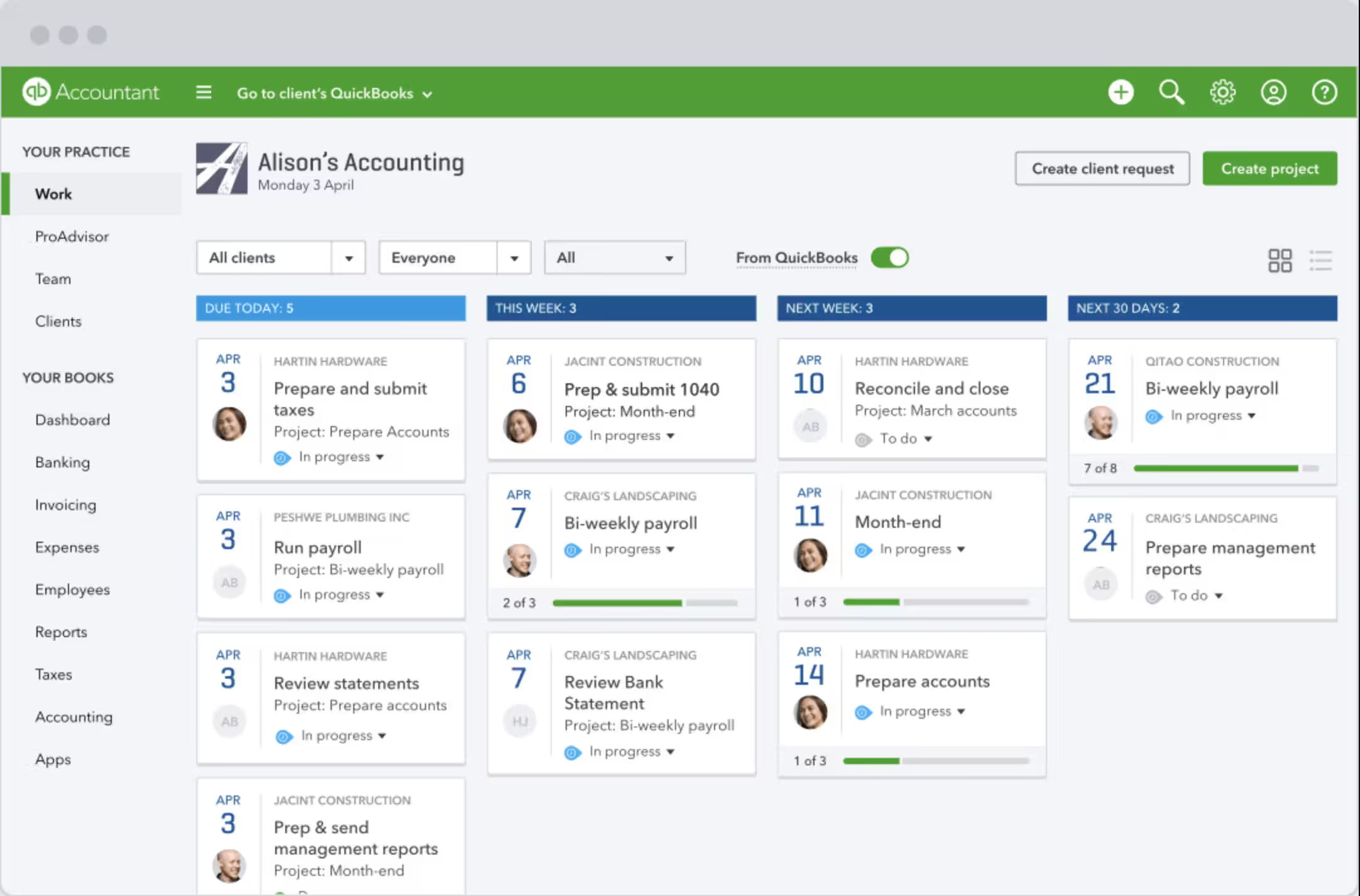

QuickBooks Online Accountant is the most popular cloud-based accounting tool for accountant and bookkeepers. It is designed for bookkeeping, payroll, and general financial management.

It has an intuitive interface that make it easy to manage accounting tasks such as invoicing, expense tracking, payroll process and reporting. However, we should mention that it is not built specifically as a tax compliance platform, and needs other tools to manage advanced taxes and audits.

As your firm scales and takes on more complex clients, QuickBooks’ limitations, particularly in advanced reporting, audit support, and tax compliance, become more evident.

Best features for CPA firms

Who is it for

QuickBooks Online is best suited for small CPA firms, bookkeeping practices, or firms serving small to mid-sized business clients with straightforward financial needs.

It works well as a foundation for firms that primarily handle bookkeeping and payroll, but larger or more complex firms will likely need additional software to meet compliance and audit requirements.

Pros

Cons

⭐⭐⭐⭐⭐ Ratings

G2 4.6/5

Overview

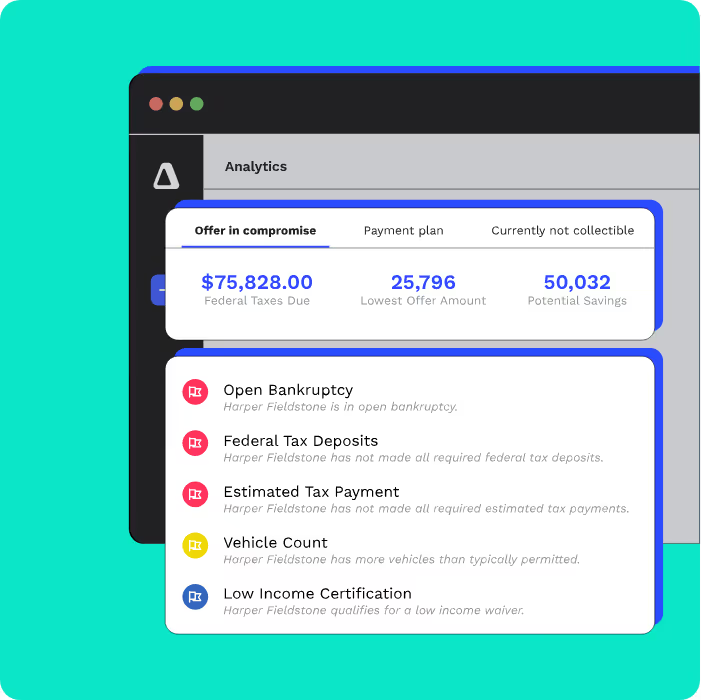

Canopy is a cloud-based practice management and tax resolution platform designed specifically for accounting firms.

It provides an all-in-one environment where CPAs can manage client records, handle tax preparation, track cases, and automate key workflows.

The platform also includes secure client portals for document sharing and communication, helping firms maintain professional client relationships.

While CanopyTax offers significant value in tax resolution and practice management, firms with advanced reporting or compliance needs may find themselves integrating additional tools to round out their technology stack.

Many firms highlight its effectiveness in tax resolution cases and automating workflows. However, some reviews note that its reporting and compliance features may not fully meet the needs of firms handling highly complex or multi-entity clients, requiring supplemental tools.

Best features for CPA firms

Who is it for

Canopy is best suited for small to mid-sized CPA firms that prioritize efficiency in tax preparation, resolution, and client management.

It’s especially valuable for firms that want to consolidate client communication, workflow automation, and document handling into one streamlined system.

Pros

Cons

⭐⭐⭐ Ratings

G2 3.5/5

Overview

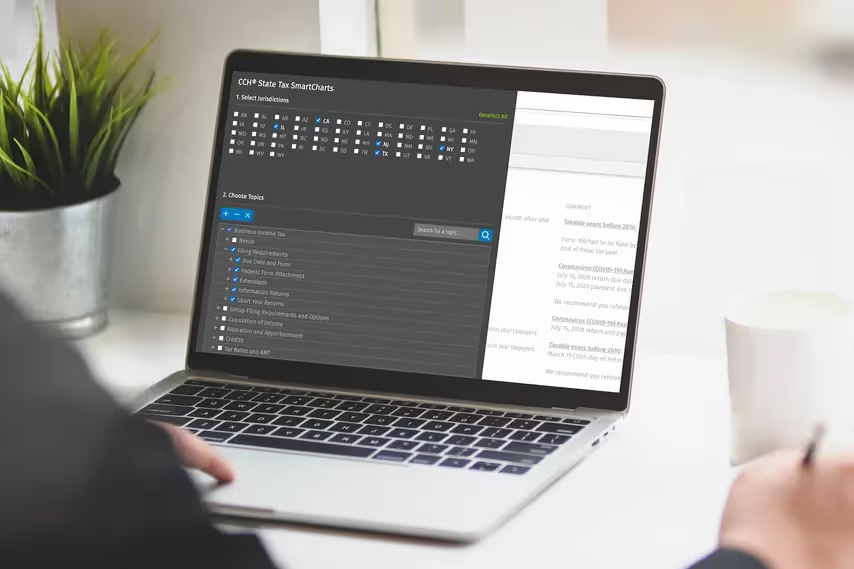

Wolters Kluwer is a popular accounting tool among CPA firms.

It offers professional-grade tax, audit, and accounting solutions designed for firms that require advanced compliance, scalability, and accuracy.

Wolters Kluwers hosts CCH Axcess, a cloud-based platform that integrates tax preparation, document management, workflow automation, and audit support.

Unlike smaller tools that focus on bookkeeping or payroll, Wolters Kluwer provides a highly specialized environment built to handle complex compliance requirements, regulatory changes, and multi-entity structures.

It has a cloud-based infrastructure to handle documents securely, and automation features to manage many clients with multi-staff workflows.

Best features for CPA firms

Who is it for

Wolters Kluwer is best suited for mid-sized to large CPA firms that need deep compliance tools, advanced tax preparation, and robust audit support, particularly within the United States.

Firms that prioritize regulatory accuracy, scalability, and secure client data management will find it particularly valuable.

Pros

Cons

Accounting software should be a must in your CPA firms.

But furthermore, an accounting software that specializes on certified public accountants is more important.

You need a tool that can handle the complexity of tax laws, clients’ demands, and data security.

So, how can you choose?

If you’re choosing an accounting software, ask yourself these crucial questions:

There is one tool that ticks all the boxes.

Eleven offers you secure document management, workflow automation, advanced compliance tools, and a universal tax engine.

1. Can general accounting software work for a CPA firm?

Basic tools like Xero or QuickBooks may work for bookkeeping but usually fall short in advanced tax compliance, reconciliation, and security requirements.

You should consider using tools like Eleven, with dedicated CPA features.

2. What makes CPA accounting software different?

CPA software includes features like encrypted document management, automated tax engines, multi-entity support, and compliance tracking that general tools lack.

3. Do CPA firms need cloud-based accounting solutions?

Yes, cloud-based platforms improve accessibility, collaboration, and security while reducing dependency on physical servers and paper storage.

4. How do CPA firms ensure client data security?

By choosing accounting software with robust encryption, role-based access, and dedicated document management systems instead of insecure generic file storage.

5. Which software is best for small CPA firms?

Smaller firms may use QuickBooks or Xero for bookkeeping but should consider transitioning to CPA-focused platforms like Eleven as compliance needs grow.