Pricing shouldn’t feel like guesswork.

Yet many CPA firms still rely on gut feel, outdated rates, or competitor rumors.

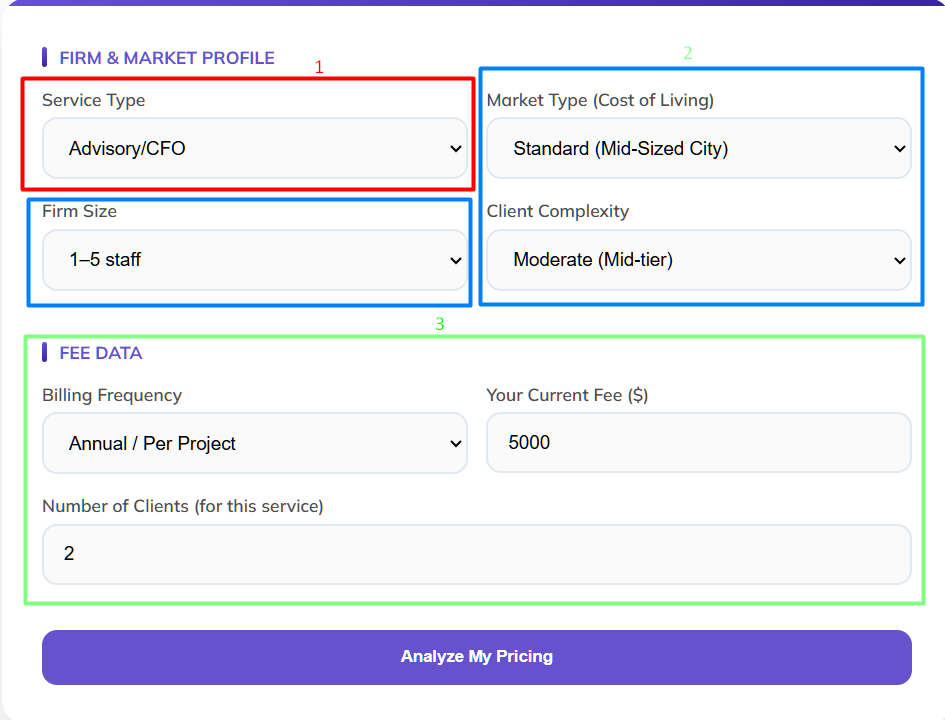

This free CPA fee benchmarking calculator helps you quickly see how your fees compare to current market benchmarks - based on service type, firm size, market cost, and client complexity.

No spreadsheets, no need to sign up, and no need to give us any info! The calculation all happens locally, in your browser.

This tool answers three critical questions for anyone responsible for pricing CPA services:

Instead of generic averages, the calculator adjusts benchmarks using real-world factors that actually affect CPA pricing.

Using the tool takes less than a minute:

Select the service you’re benchmarking:

Each service has very different pricing dynamics.

Set the context for your pricing:

These inputs matter more than most firms realize.

Add:

This allows the calculator to show not just variance, but potential revenue impact.

Click on Analyze my Pricing and the calculator will show you:

If you’re under market, it also estimates potential annual revenue growth.

Numbers matter, but context matters more.

Pricing only makes sense when you see how firm size, client mix, and market conditions interact.

The examples below show how small pricing gaps can turn into meaningful revenue differences over time.

A mid-size CPA firm in a standard US market charges $2,400 for business tax returns.

The firm has solid processes, experienced staff, and serves mostly established SMBs.

When the firm runs the calculator, it selects:

The result shows:

What this reveals:

The firm is delivering work at a level the market already values higher. The pricing gap isn’t about efficiency or quality. It’s simply outdated pricing. Even a gradual adjustment would improve margins without changing the type of clients served.

A small CPA firm offers CFO advisory services at $5,500 per year in a high-cost metro area.

The firm works closely with a handful of clients and positions itself as a strategic partner, not a commodity provider.

Calculator inputs:

The result shows:

What this reveals:

Pricing is healthy and aligned with the market. There’s no immediate pressure to raise fees, but also little room to discount without eroding perceived value. The firm can focus on delivery and positioning rather than pricing corrections.

A CPA firm charges $850 per month for bookkeeping and serves 40 clients on this service.

Individually, the fee feels reasonable and clients rarely push back.

The calculator shows the firm is $250 below benchmark per client.

What this reveals:

That gap compounds quickly. Across 40 clients, the firm is leaving six figures of annual revenue on the table. Underpricing often goes unnoticed because each individual decision feels small, but the cumulative impact is significant.

These examples show why benchmarking matters.

Pricing issues rarely come from one bad decision—they come from many small ones that were never revisited.

Because pricing decisions rarely fail all at once.

They erode margins slowly.

A CPA fee benchmarking calculator helps you step back and answer questions that are hard to see from inside the firm.

It helps you:

For CPA firms and family offices, this is less about charging more—and more about charging appropriately.

Even small adjustments, when applied consistently, can improve profitability without increasing workload.

Yes. There’s no sign-up, no account, and no email required.

Benchmarks are based on current industry averages and adjusted using market cost, firm size, and engagement complexity.

They are meant as guidance, not rigid rules.

No. It gives context and direction, not final answers. Think of it as a starting point for smarter pricing decisions.

Yes. The calculator adjusts based on billing frequency to estimate annual impact.

Benchmarking is only the first step.

Execution is where firms win or lose.

Eleven is an accounting platform built for CPA firms and family offices that need more control after pricing decisions are made.

With Eleven, you can:

If you’re adjusting fees, improving margins, or standardizing services, having the right invoicing and accounting system matters.

👉 Try Eleven’s free trial and see how pricing insights turn into smoother billing and stronger cash flow.