The Perks of Automated Bookkeeping for Accounting Pros

Still doing the books in Excel? Read on to learn why and how to automate bookkeeping to your advantage, even if you handle clients with few transactions.

Discover how automated accounting solutions transform bookkeeping and finance management. Find out about features, top tools like Eleven and Xero, and tips on choosing the right platform.

Eleven revolutionizes automated accounting solutions by providing unparalleled accuracy, seamless integration, and enhanced security, redefining efficiency for modern businesses.

In this article

You can automate almost 75% of your accounting tasks.

However, you need the best automated accounting solutions to ensure that you’re getting accurate results and reports.

In this article, we’ll explain what these solutions are and how they can help. Plus, we’ve thrown in 5 of our favorite tools.

An automated accounting solution is software designed to handle accounting tasks and financial processes using AI.

Accounting tools will help you automate repetitive tasks such as data entry, transaction processing, invoicing, bank reconciliations, and financial reporting, among others.

All these tasks can be carried out with minimal human interaction, although, you will need to ensure that the data is accurate, after all, these tools rely on the quality of your data in order to work efficiently.

AI in accounting will automate these workflows, businesses can reduce errors, save time, improve accuracy, and ensure compliance with financial regulations.

Automated accounting solutions are typically cloud-based and integrate with other business systems, offering real-time access to financial data. This allows organizations to make informed decisions quickly and maintain a clear overview of their financial health.

Automated accounting solutions allow accountants to free up time to focus on providing clients valuable insights and strategic advice.

There are many automated accounting solutions you can depend on depending on your specific needs. Some solutions include:

An automated general ledger is an automated accounting system that records, organized, and updates your financial transactions.

Unlike traditional systems, an automated general ledger integrates with the rest of your accounting solutions so it can capture transactions automatically and in real time, essentially turning the general ledger into the backbone of your automated accounting systems.

The automation of the general ledger reduces human error, simplifies audit preparation, and speeds up the closing process.

It also provides immediate visibility into financial performance through real-time reporting and dashboards. By centralizing all financial activity, an automated general ledger helps organizations maintain compliance, support strategic planning, and scale their operations more efficiently.

For example, Eleven's general ledger solution captures and posts transactions in real time, ensuring that financial records are always up to date. With built-in controls and audit trails, businesses can maintain transparency, enhance data accuracy, and easily generate financial statements.

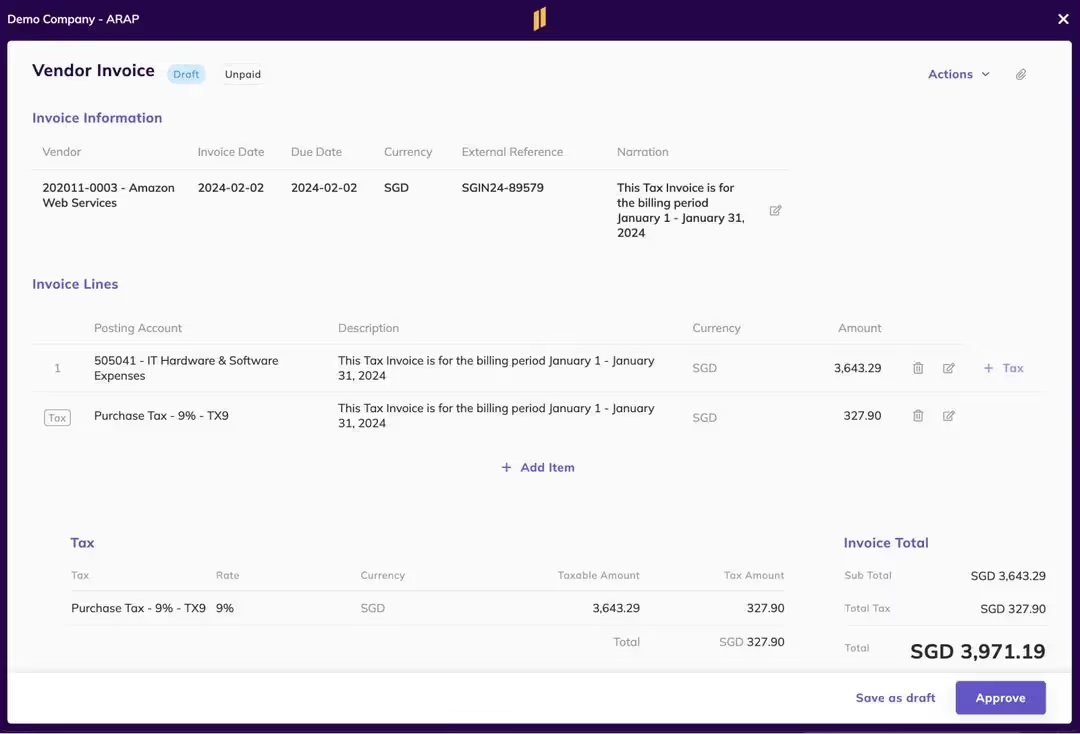

Within your general ledger, you can include automated accounts payable (AP), in order to automate the management of outgoing payments.

AP workflows automatically capture invoices, match them to purchase orders, route them for approval, and schedule payments.

This reduces the risk of late fees, duplicate payments, and fraud.

With AP automation, businesses can speed up and shorten payment cycles and gain visibility into liabilities and cash flow.

On the other hand, you can also find automated accounts receivable (AR) so you can automatically manage incoming payments.

This helps you control liquidity and cash income.

An AR solution should automatically generate and send invoices, track payment statuses, issue reminders, and reconcile receipts with bank data.

By reducing delays and errors in billing and follow-up, you can improve Days Sales Outstanding (DSO) and keep healthier cash flows.

Automated bookkeeping means using AI to manage and record your financial transactions without the need for constant manual input.

It takes care of routine tasks such as recording sales, categorizing expenses, reconciling bank statements, and tracking receipts by connecting to financial data sources like bank feeds, invoicing platforms, and payroll systems.

The result is a more efficient, accurate, and timely bookkeeping process that reduces human error and reduces administrative workload.

Automated bookkeeping ensures consistency in data entry and simplifies compliance with tax and regulatory requirements.

Essentially, you're replacing spreadsheets and manual data entry with AI-driven automation.

Analytical accounting is a method of financial management that allows businesses to break down and analyze financial data across different departments, projects, or cost centers, etc., to gain deeper insights into performance.

This approach goes beyond basic bookkeeping, as it attaches additional attributes (like tags or dimensions) to transactions, enabling more granular tracking and analysis.

Analytical accounting tools can generate real-time reports and dashboards that reveal trends, inefficiencies, or profitability across various business segments.

Analytical accounting is especially valuable if you manage complex operations or multiple revenue streams, where financial clarity is essential for growth and sustainability.

While many are still afraid that AI will replace accountants, bringing automated accounting solutions into your firm brings many benefits. Particularly to efficiency and accuracy.

The benefits include:

Automated accounting takes manual tasks out of the mix.

Tasks such as data entry, bank reconciliations, invoice processing, and report generation can be done automatically and, therefore, save you time.

This allows you and your finance teams to shift focus toward strategic analysis, forecasting, and business planning rather than routine bookkeeping.

Manual accounting processes are prone to human error. It is common to find mistyped numbers, miscategorized transactions, or overlooked entries, and in many cases, going back to see where the mistake is can take hours of your time.

Automation drastically reduces these risks by standardizing data entry and using rules-based processing to ensure consistency.

Automated systems provide up-to-date financial data through dynamic dashboards, live reporting tools, and seamless bank feeds.

This real-time visibility allows to monitor cash flow, expenses, and performance metrics continuously, allowing faster and more informed decision-making. It also supports more agile responses to unexpected changes in market conditions or operational needs.

Automated accounting systems come with built-in audit trails, version histories, and compliance features that help businesses stay aligned with local regulations, tax laws, and financial standards.

Documentation is automatically archived, categorized, and searchable, making audits faster and less disruptive.

With standard processes and accurate reporting, it is much easier for you to meet regulatory requirements and deadlines.

As your firm grows, you will gain more clients with more complex finances. That is the goal, after all.

If you’re still doing your accounting manually, this will results in expanding your team quite regularly, changing your system and bending over backwards to make your deadlines.

Automated systems are designed to scale and support multi-entity structures, global currencies, and increased transaction volumes without requiring a proportional increase in staff.

This scalability ensures that your business remains efficient and manageable even as it grows (fast).

Most modern automated accounting solutions are cloud-based and offer advanced security protocols, including encryption, role-based access controls, and secure backups.

These measures help protect sensitive financial data from breaches, loss, or unauthorized access. Additionally, consistent automation helps maintain the integrity of financial data over time.

Before you pick a tool, make sure you know what tasks you need from your accounting solution and define your expectations.

We’ll leave you with a short review of our favorite accounting solutions, if you’re looking for more in depth details, check out the 8 best AI accounting software.

Eleven is an all-in-one AI‑powered cloud accounting platform fueled by its own AI assistant “Luca‑AI” for smart data extraction and categorization.

It is designed for accounting firms and professional financial practices.

The platform is designed to streamline complex accounting workflows, such as general ledger processing, multi-currency transactions, automated bookkeeping, AR/AP, document management, and dynamic reporting, using AI-driven features and real-time data handling .

This AI Accounting tools offers many features such as:

Users praise its ethical AI practices, scalability for firms of all sizes, and deep customization. Users highlight its transparent automation and ability to grow with businesses .

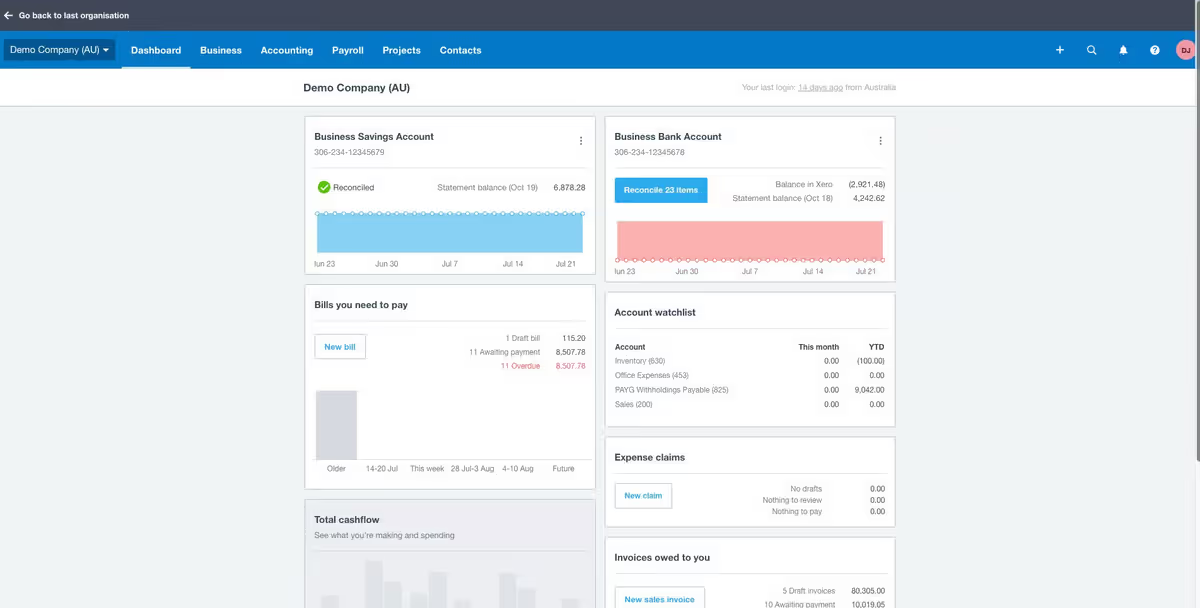

Xero is a cloud-based small-to-midsize business accounting software with automation.

It automates essential financial tasks such as invoicing, bank reconciliation, expense tracking, and payroll, offering real-time visibility into business finances.

It’s especially popular among startups and service-based companies due to its accessibility, scalability, and international support for multi-currency transactions.

Some features include

Source: G2

Xero is highly rated for its intuitive interface and international support. One user noted:

“Xero has transformed how we manage our finances. The multi‑currency feature is a lifesaver for our international operations.”

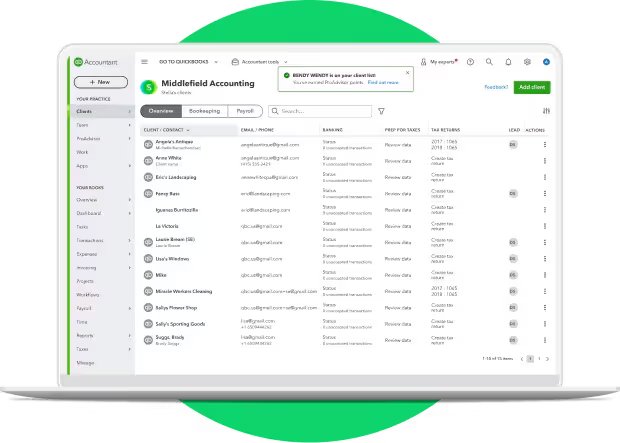

QuickBooks Online is a cloud-based accounting with built-in AI features for SMBs

It automates accounting tasks such as invoicing, expense tracking, bank reconciliation, payroll, and financial reporting.

QuickBooks Online provides real-time access to financial data and supports collaboration between business owners and accountants. Its scalability and wide adoption make it one of the most popular accounting platforms.

Some features include:

QuickBooks Online is widely used and user-friendly; however, some report stability issues and customer-service concerns. On Reddit, one accountant says:

“QuickBooks might appear user friendly… but it has a lot of bugs… auto mileage never works.”

Sage Intacct is a cloud-based mid-to-enterprise financial management & ERP solution

It is known for its scalability and strong compliance capabilities, Sage Intacct is especially suited for organizations with complex financial structures, including nonprofits, software companies, and multi-location enterprises.

Some of the most popular features include:

Users who trust this tool include mid-to-large businesses who look for detailed reporting and multi-entity support. One Redditor remarks:

“SAGE… extremely detailed/more customizable reporting… better inventory functionality.”

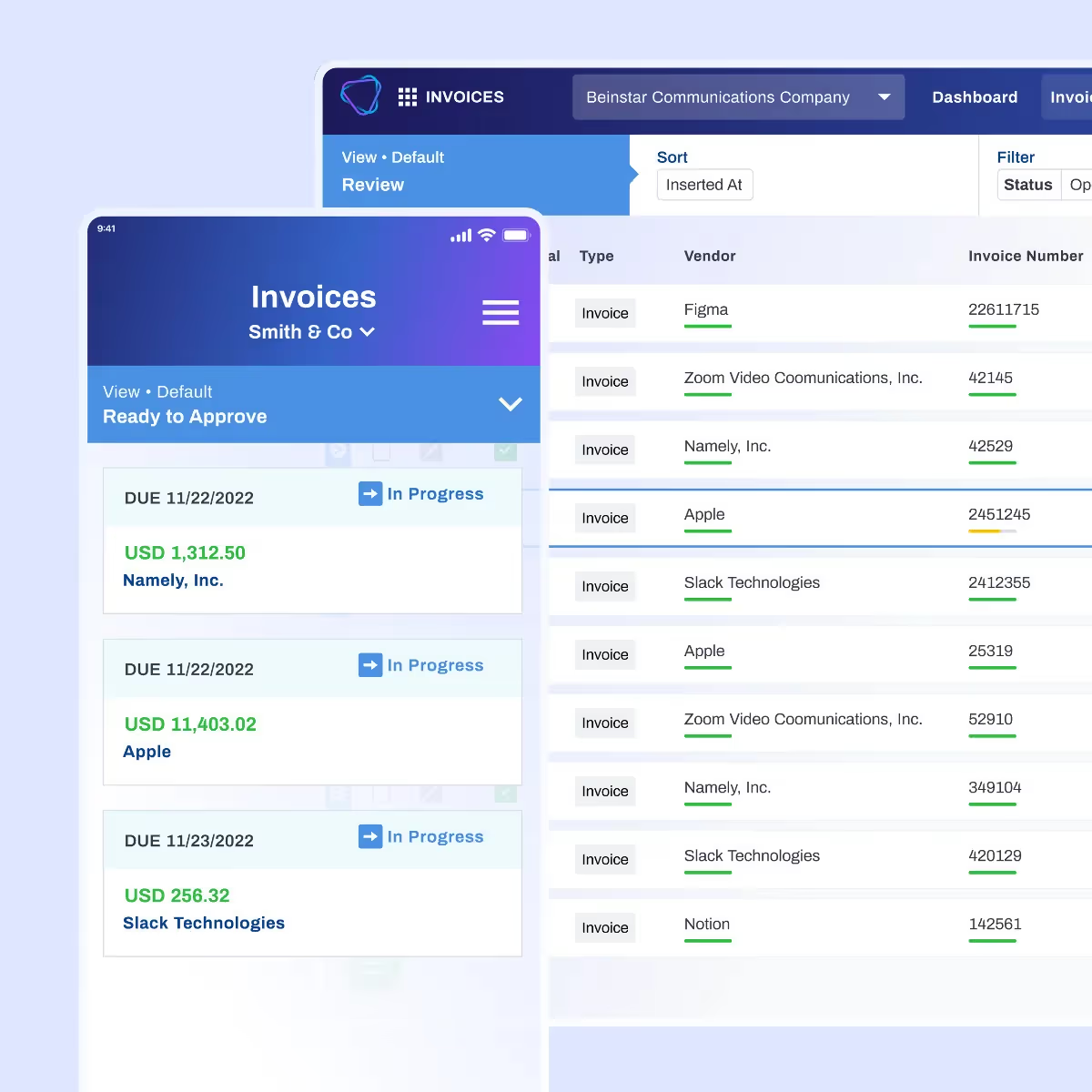

Vic.ai is an AI-first accounts payable (AP) automation platform for mid-market and enterprise companies, especially in real estate, manufacturing, and retail.

It uses proprietary machine learning, trained on over a billion invoices, to automatically ingest, extract, match, and approve invoices.

It integrates with larger ERPs such as QuickBooks, Xero, Oracle, etc.

It offers many features such as:

Users enjoy its speed and accuracy in AP automation, and its high-volume invoice handling and improved cash flow control. However, some mention limited reporting and a steep learning curve .

Implementing automated accounting solutions in your business should be a must.

This will help you stay current and offer your clients a comprehensive service, where you can manage their finances, but also give them the best strategic advice based off of accurate and realist reports.

Eleven meets this demand and sets new benchmarks for accuracy, efficiency, and growth.

Start your test drive with Eleven now!

A general ledger is the central record-keeping system for all of a company’s financial transactions.

It organizes data into accounts like assets, liabilities, income, and expenses to produce key financial statements.

The five main elements of the general ledger are assets, liabilities, equity, revenues, and expenses.

These categories form the foundation of a business’s financial reporting and reflect its overall financial health.

Yes, bookkeeping can be largely automated using software that records transactions, categorizes expenses, reconciles accounts, and generates reports.

Automation reduces errors, saves time, and keeps financial data up to date.

While many accounting tasks can be automated, like data entry, invoicing, and reconciliations, full automation is rare.

Human oversight is still essential for judgment-based tasks, compliance decisions, and strategic financial planning.

No, AI will not replace accountants but will transform their role.

Routine tasks will be handled by automation, allowing accountants to focus on analysis, advisory services, and high-level decision-making.