The Perks of Automated Bookkeeping for Accounting Pros

Still doing the books in Excel? Read on to learn why and how to automate bookkeeping to your advantage, even if you handle clients with few transactions.

In this article, we define why you need invoice accounting software, what features it should have, and our 7 favorite choices.

An invoice accounting software is a tool created to automate and manage your invoicing process, from its creation, to automated reminders, and payment.

In this article

Managing invoices manually might work at first, but as your business grows, errors and delays start to pile up.

Missed payments, duplicate entries, and messy spreadsheets can quickly disrupt cash flow.

Invoice software manages the process, automating, organizing, and keeping every transaction accurate and contained within one platform.

Invoice accounting software is a type of accounting tool designed to automate and manage the process of creating, sending, tracking, and recording invoices within a business’s financial system.

It helps both accountants and business owners handle the full invoicing cycle, from issuing invoices to clients, to recording payments received, to reconciling them against bank transactions.

For accounting firms, invoice accounting software ensures that every invoice issued or received by clients is accurately reflected in their books, for more efficient bookkeeping, tax preparation, and financial reporting.

Invoice accounting software comes in several forms, each designed to address different business needs. Understanding the main types can help you choose the right solution for your workflow, so we’ve explained them below.

Approval software is a tool that adds an approval workflow to the invoicing process, ensuring that every invoice is reviewed, verified, and authorized before it’s sent to a client or processed for payment.

In accounting firms and larger businesses, invoices often need to pass through multiple layers of approval.

For example, a bookkeeper might prepare the invoice, a manager or partner reviews it for accuracy, and a senior approver signs off before it’s finalized.

Approval invoicing software automates this workflow, helping maintain control, consistency, and compliance.

The software typically lets users set approval rules based on criteria such as amount, department, project, or client. Once an invoice is created, it’s automatically routed to the right person for review.

Approvers can check supporting documents, verify line items, add comments, and approve or reject the invoice, all within the platform.

Scanning software uses technology to digitize paper invoices and pull out key information automatically. Through optical character recognition (OCR) technology, these tools read invoice data and enter it directly into your accounting system.

This automation eliminates the tedious work of manual data entry and significantly reduces the likelihood of human error when processing large volumes of invoices.

Automated scanning solutions offer substantial advantages when working on accounts payable. The technology can improve speed and accuracy compared to traditional manual processing methods, as, when reviewing manually, it is easy to miss details like incorrect amounts or mismatched vendor information, whereas scanning software consistently captures every piece of information.

This reliability frees you up to focus on higher priority tasks, rather than repetitive data entry.

Billing software can help you manage and process payments, often with automation options.

Online billing software requires an internet connection and allows users to access billing data from anywhere, while offline billing tools store information on a local device, so you can access it without internet.

When choosing billing software, it’s important to check whether it’s cloud-based, as this affects how and where you can manage your billing and payment tasks.

Basic billing systems are typically suitable for small businesses with simple accounts payable needs, whereas larger organizations often require more advanced platforms capable of handling complex workflows, higher volumes of transactions, and greater integration with other financial tools. Eleven is a good option if these are features your firm is looking for.

One key feature of invoice software that is particularly useful and sought after nowadays is automation, which will help you generate invoices directly from recorded transactions, calculate taxes, and apply payments automatically.

A good software will also support multi-currency and multi-company accounting, making it easier for firms to manage clients across different locations and currencies without manual conversions or duplicate entries.

Integrated accounts payable and receivable tools can help you track incoming and outgoing payments, monitor overdue invoices, and maintain a clear picture of cash flow.

Some systems now include built-in document management features, allowing users to upload and store invoices, receipts, and other financial documents in one place.

Advanced platforms like Eleven can extract data from PDFs or images using AI-powered recognition, converting them into structured financial entries and linking them directly to transactions. This not only reduces manual data entry but also helps ensure that every invoice is properly supported and auditable.

Additional features such as custom reporting, real-time dashboards, and data validation enable firms to review performance, identify discrepancies, and maintain compliance with accounting standards.

Handling invoices manually can work for a while, but as your business or client base grows, it quickly becomes time-consuming and prone to errors.

Without invoice software, mistakes such as duplicate entries, missed payments, or incorrect amounts can happen easily, leading to confusion in your records and issues with cash flow.

Managing invoices across emails or spreadsheets also makes it harder to stay organized and keep track of due dates, especially when dealing with multiple clients, currencies, or payment terms.

Over time, this lack of structure can lead to delayed payments, strained client relationships, and difficulties when it comes to audits or tax reporting.

Invoice software addresses these issues by automating and centralizing the entire invoicing process.

It enables you to create, send, and track invoices from one system while keeping all related financial data accurate and up to date.

With built-in features such as automatic data uploads, payment reminders, and reconciliation tools, software can reduce the manual work and minimize the risk of errors.

All documents and payment records are stored securely in one place, making it simple to find information when you need it.

So you can compare different invoice tools easily and directly we’ve included a comparison table below, followed by a more in-depth look at each one:

⭐⭐⭐⭐⭐ Rating: 4.9/5 (Capterra)

Overview

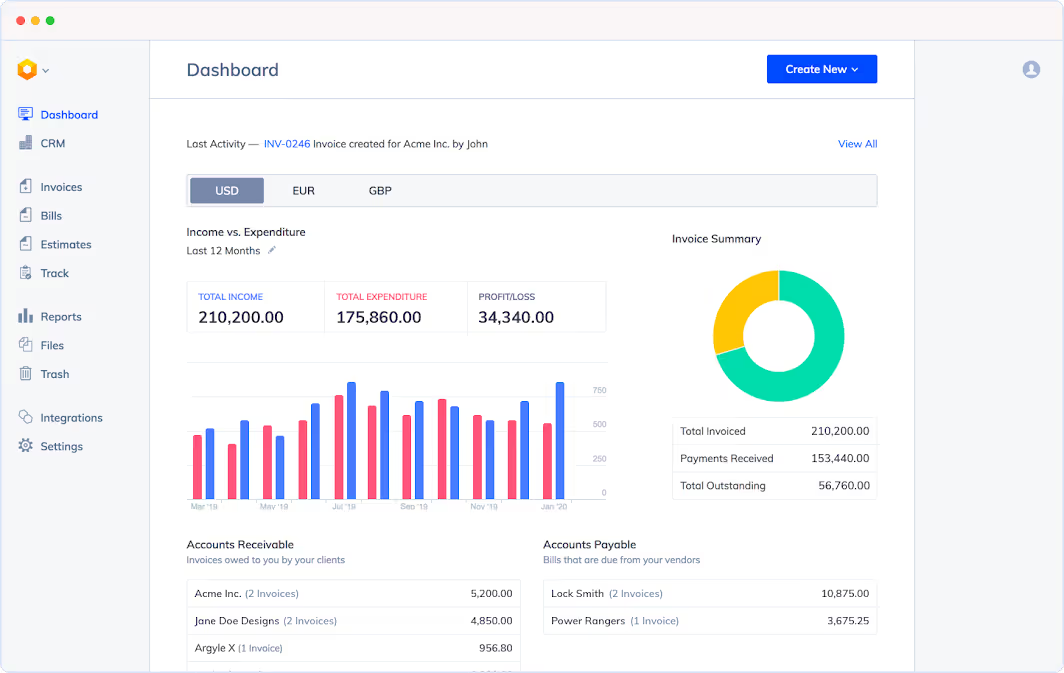

Eleven is scalable, cloud-based accounting software built for accounting firms and multi-entity businesses. It combines invoicing, bookkeeping, and document management in one place.

Designed for automation, it makes AR/AP processes, reconciliation, and reporting easier, helping accountants reduce manual work while keeping records consistent and compliant.

Features

Pros

Cons

Best For: Accounting firms or growing businesses that want end-to-end workflow automation rather than basic invoicing.

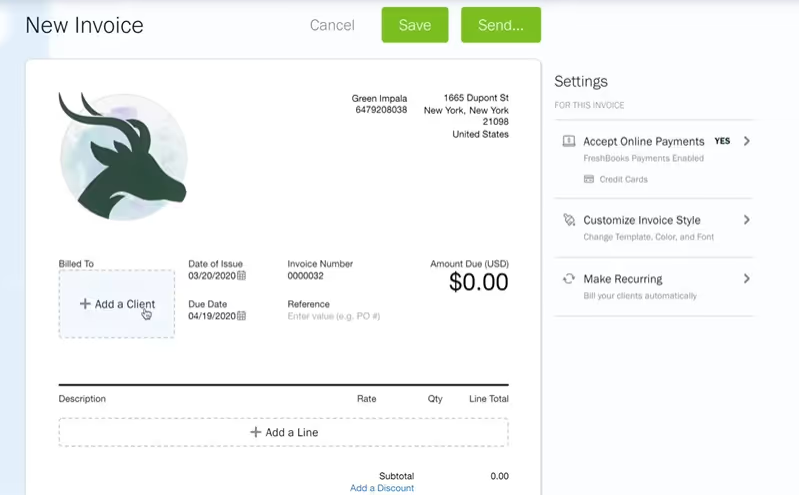

⭐⭐⭐⭐ Rating: 4.3/5 (Capterra)

Overview

QuickBooks Online is one of the most popular cloud accounting platforms, offering invoicing, bookkeeping, and financial management. It integrates with a wide range of apps, making it a reliable option for small and medium-sized businesses.

It also offers a free invoice generator.

Features

Pros

Cons

Best For: Small to medium-sized businesses that need invoicing with full accounting functionality and robust integrations.

⭐⭐⭐⭐ Rating: 4.5/5 (Capterra)

Overview

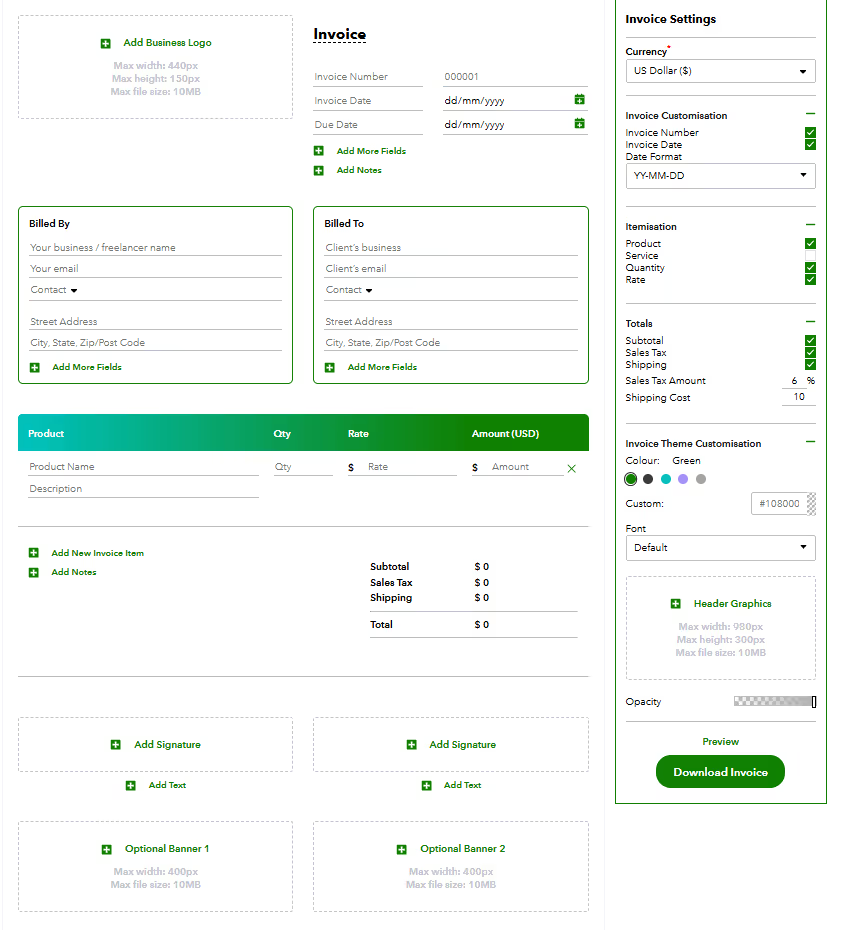

FreshBooks is a cloud invoicing and accounting platform designed for freelancers and small service-based businesses. It focuses on simplicity and combines invoicing with time tracking, expense tracking, and client management.

Features

Pros

Cons

Best For: Freelancers and small service businesses that need professional invoicing and time tracking in one platform.

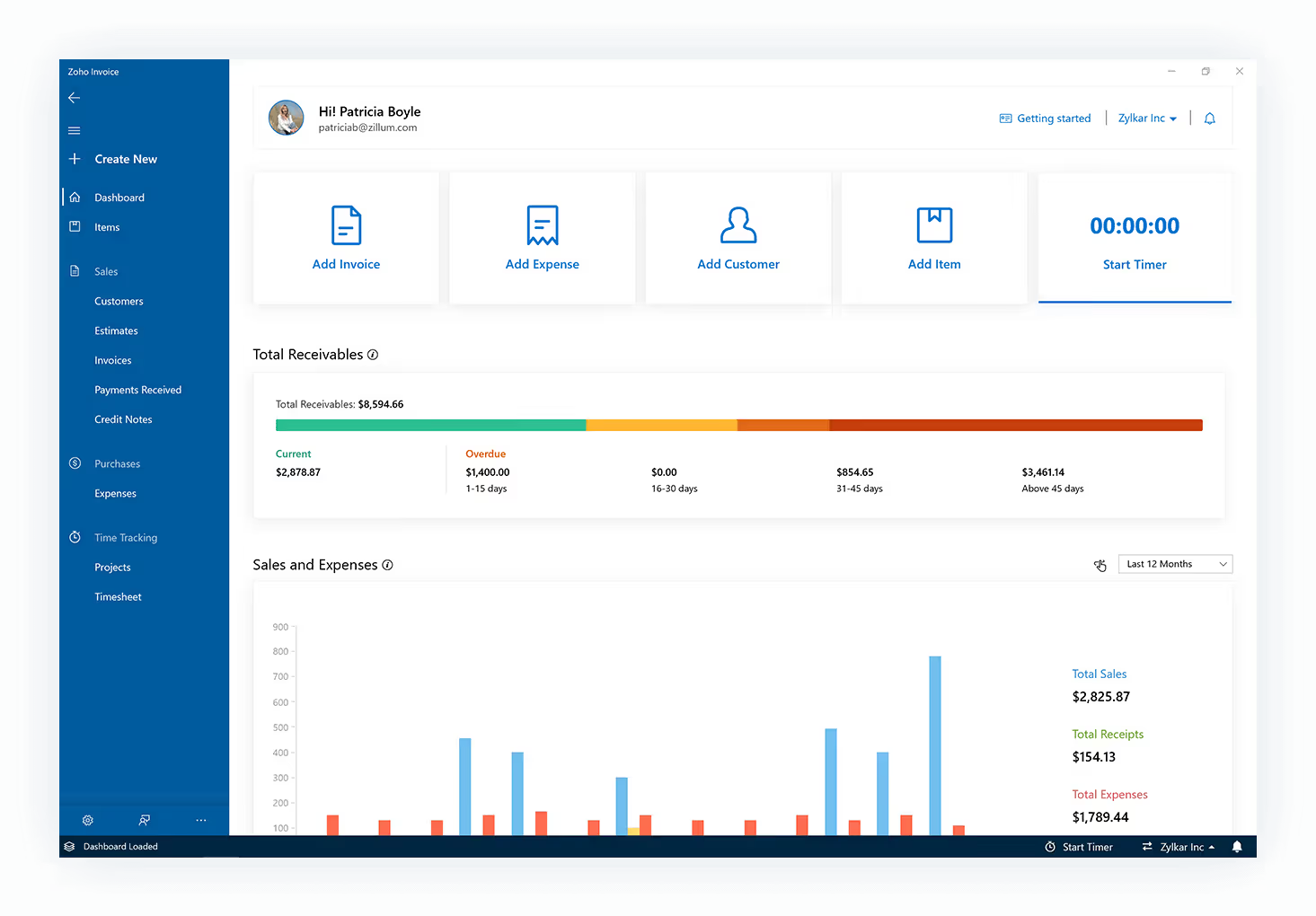

⭐⭐⭐⭐⭐ Rating: 4.7/5 (Capterra)

Overview

Zoho Invoice is a dedicated invoicing tool that’s part of the larger Zoho ecosystem. It’s known for affordability, good customization features, and ease of use, particularly for small businesses and startups.

Features

Pros

Cons

Best For: Startups and small businesses looking for free or low-cost invoicing with reliable automation tools.

⭐⭐⭐⭐ Rating: 4.4/5 (Capterra)

Overview

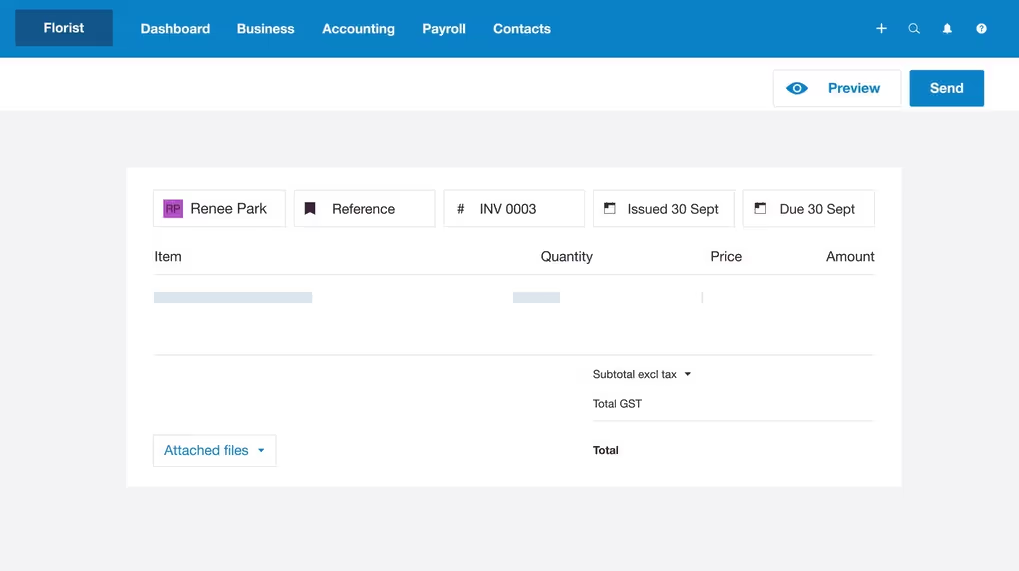

Xero is a powerful cloud accounting system that includes invoicing, reconciliation, payroll, and reporting. It’s good for service-based and mobile businesses that need full accounting with a strong invoicing component.

Features

Pros

Cons

Best For: Service-based businesses and agencies that want comprehensive accounting and invoicing in a mobile-friendly platform.

⭐⭐⭐⭐ Rating: 4.7/5 (Capterra)

Overview

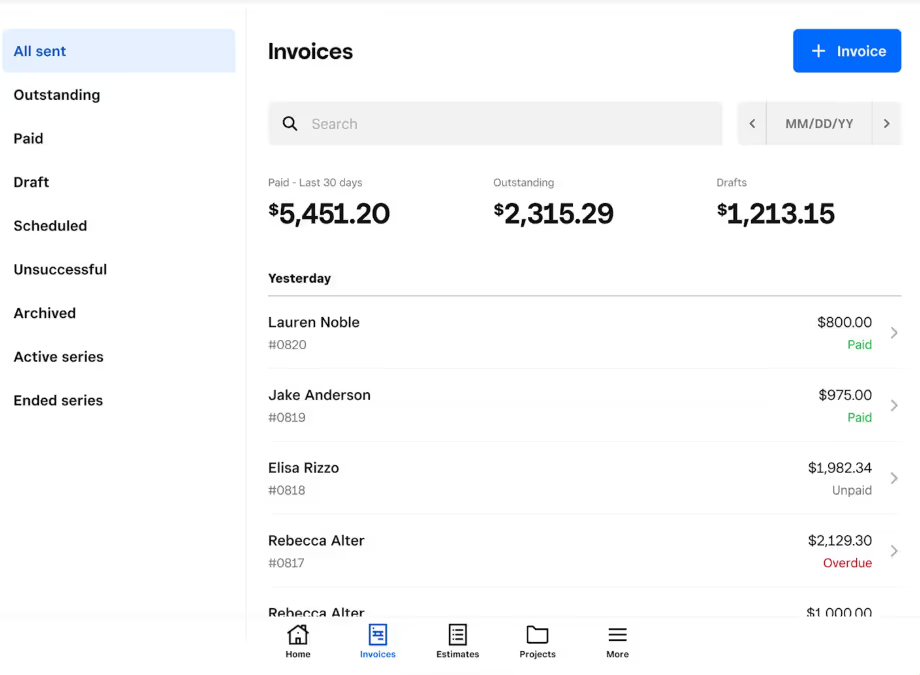

Square Invoices is part of the Square payment ecosystem, offering simple, free invoicing tools for small retail businesses and freelancers. It integrates seamlessly with Square POS and payments.

Features

Pros

Cons

Best For: Small businesses, freelancers, and retail stores already using Square who need simple and cost-free invoicing.

⭐⭐⭐⭐⭐ Rating: 4.9/5 (Capterra)

Overview

Hiveage is a cloud-based invoicing and billing platform designed primarily for freelancers and small businesses. Its focus is on simplicity, speed, and ease of use for basic invoicing workflows rather than full-scale accounting.

Features

Pros

Cons

Best For: Freelancers, sole-traders or very small businesses with straightforward invoicing and billing needs, who want a cost-effective solution rather than a full accounting suite.

Choosing the right invoice accounting software depends on your business size, workflow complexity, and goals. Whether you need simple invoicing or end-to-end automation with advanced bookkeeping, the right tool can save you time, reduce errors, and improve cash flow visibility.

If you’re ready to improve your invoicing and accounting workflows, Eleven offers powerful automation, multi-entity support, and seamless integration designed specifically for accounting firms and growing businesses.

Try Eleven today and experience smarter, faster financial management.